6 Multiple Linear Regression

6.1 Introduction

Multiple linear regression is one of the central tools in statistical modeling, serving as the foundation for much of modern data analysis. It extends the simple linear regression framework by allowing the outcome variable to depend on several predictors simultaneously, capturing more complex relationships and improving both explanatory and predictive power.

In many real-world situations, outcomes are rarely determined by a single factor. Economic growth, for instance, may depend not only on investment but also on inflation, interest rates, and exports; a student’s academic performance may be influenced by study habits, socioeconomic status, and prior preparation. Multiple linear regression provides a systematic way to model these multivariate relationships within a coherent mathematical framework.

6.1.1 The General Model

The multiple linear regression model can be written as

\[ y_i = \beta_0 + \beta_1 x_{1,i} + \beta_2 x_{2,i} + \ldots + \beta_p x_{p,i} + e_i, \quad i = 1, \ldots, n, \]

where:

- \(y_i\) is the dependent (or response) variable for the \(i\)th observation,

- \(\beta_0\) is the intercept, representing the expected value of \(y\) when all predictors are zero,

- \(\beta_1, \beta_2, \ldots, \beta_p\) are the regression coefficients that quantify the change in \(y\) associated with a one-unit change in each predictor, holding the others constant,

- \(x_{1,i}, x_{2,i}, \ldots, x_{p,i}\) are the independent (or explanatory) variables, and

- \(e_i\) is the random error term, capturing unobserved variability or model imperfections.

This formulation is typically expressed more compactly in matrix notation as

\[ \mathbf{y} = \mathbf{X}\boldsymbol{\beta} + \mathbf{e}, \]

where \(\mathbf{y}\) is the \(n \times 1\) vector of responses, \(\mathbf{X}\) is the \(n \times (p+1)\) design matrix including a column of ones for the intercept, \(\boldsymbol{\beta}\) is the \((p+1) \times 1\) vector of unknown coefficients, and \(\mathbf{e}\) is the vector of errors.

6.1.2 Interpretation and Objectives

Multiple linear regression serves two broad purposes:

- Explanation – to understand how several predictors jointly influence the outcome and to quantify their individual effects after controlling for the others.

- Prediction – to use the estimated relationship to forecast new outcomes based on known predictor values.

In practice, both objectives are often pursued simultaneously. The coefficients \(\beta_j\) represent partial effects: each one measures the change in the expected value of \(y\) when \(x_j\) changes by one unit, while keeping all other predictors fixed. This “ceteris paribus” interpretation is what allows multiple regression to disentangle correlated effects among variables.

6.1.3 Applications and Context

This framework is widely used in fields such as econometrics, psychology, biostatistics, and machine learning. In economics, for example, GDP growth can be modeled as a function of inflation rate, unemployment, interest rate, government expenditure, and exports. By accounting for these variables simultaneously, we can separate their unique contributions and obtain a more accurate and interpretable model of economic performance.

However, this generalization introduces new challenges beyond those encountered in simple regression. Among them:

- Multicollinearity: predictors may be correlated, making it difficult to distinguish their individual effects.

- Model selection: determining which variables should be included requires careful judgment and statistical testing.

6.1.4 Connection to Polynomial Regression

We have already encountered a special case of multiple regression in the context of polynomial regression, where powers or transformations of a single predictor were treated as separate explanatory variables. In that case, the predictors were related by construction (e.g., \(x\), \(x^2\), \(x^3\), …), while here we consider the general case in which each explanatory variable represents a distinct quantity of interest.

Thus, multiple linear regression can be viewed as both a conceptual generalization and a practical extension of polynomial regression—moving from modeling curvature in one dimension to explaining multivariate variation in higher dimensions.

6.2 Example: Modeling GDP

As an applied example, consider the problem of explaining a country’s Gross Domestic Product (GDP) using several economic indicators. In this case, we include:

- Inflation rate,

- Unemployment rate,

- Reference interest rate,

- Government spending (as a percentage of GDP), and

- Exports (as a percentage of GDP).

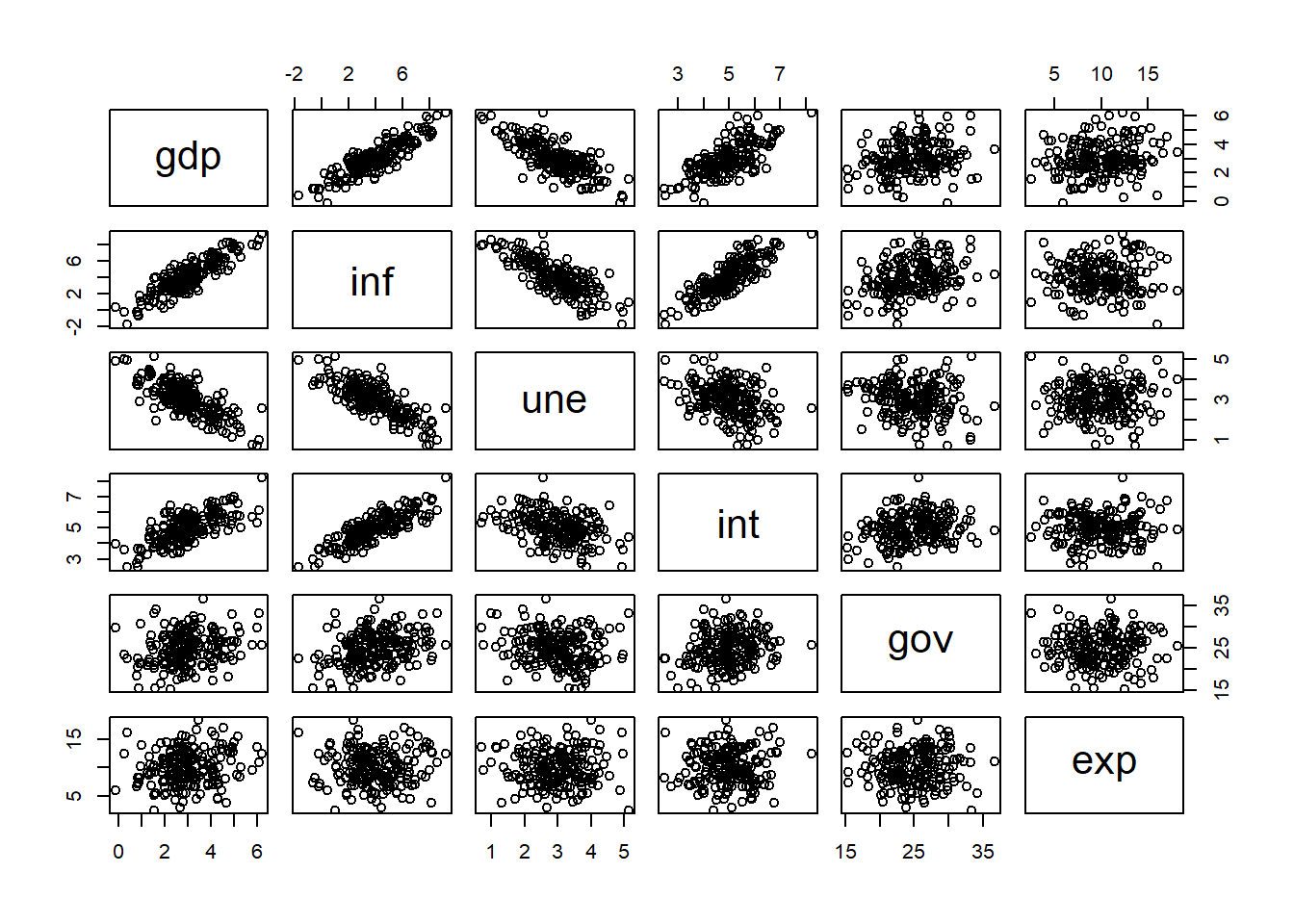

With multiple predictors, visualization becomes more challenging than in simple regression. Still, we can explore the pairwise relationships among variables using scatterplots:

# Reads Data

dat <- read.csv(file = "Gdp Data.csv")

# Plot the scatterplots for each pair of variables

pairs(dat)

The scatterplot matrix shows that some predictors are strongly related to GDP, while others are correlated with each other. This initial exploration provides useful insight before fitting regression models.

We can also examine the correlation structure numerically:

## gdp inf une int gov exp

## gdp 1.0000000 0.875131082 -0.74874795 0.6964256 0.22172279 0.173602651

## inf 0.8751311 1.000000000 -0.78173033 0.8292061 0.31103644 0.005685918

## une -0.7487479 -0.781730327 1.00000000 -0.3642453 -0.16674407 0.010553855

## int 0.6964256 0.829206121 -0.36424525 1.0000000 0.21389456 0.015699798

## gov 0.2217228 0.311036436 -0.16674407 0.2138946 1.00000000 0.018475446

## exp 0.1736027 0.005685918 0.01055386 0.0156998 0.01847545 1.0000000006.2.1 Simple Regressions

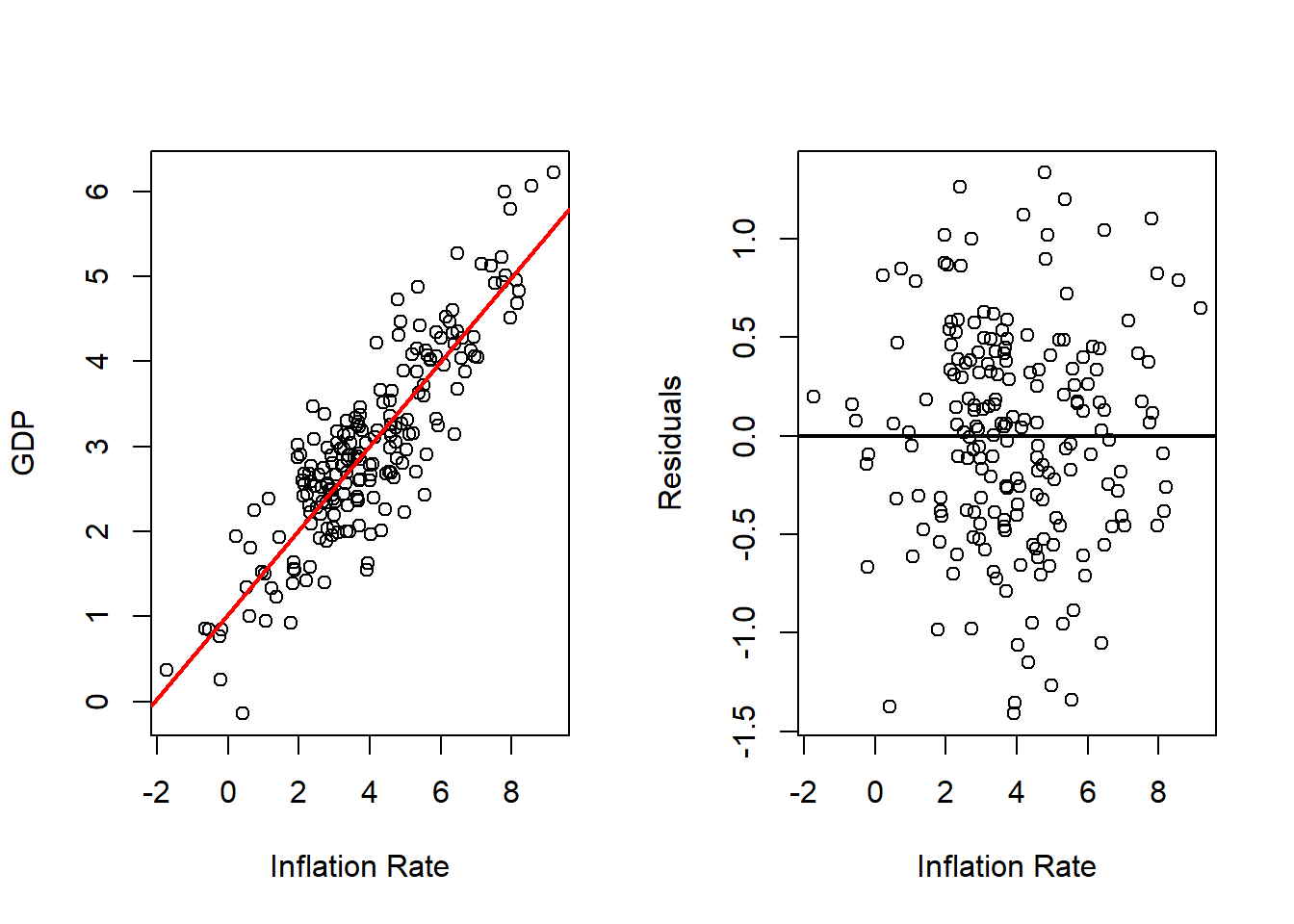

Before fitting the full multiple regression, it is instructive to look at the simple linear regressions of GDP on each predictor individually.

Inflation Rate

# Fits with Inflation

outRegInf <- lm(gdp ~ inf, data = dat)

varVal <- dat$inf

out <- outRegInf

varNam <- "Inflation Rate"

# Plots Regression Line and Scatterplot and residuals plot

par(mfrow = c(1, 2))

plot(x = varVal,

y = dat$gd,

xlab = varNam,

ylab = "GDP",

pch = 16)

abline(a = out$coefficients[1],

b = out$coefficients[2],

col = 'red',

lwd = 2)

plot(x = varVal,

y = out$residuals,

xlab = varNam,

ylab = "Residuals",

pch = 16)

abline(h = 0,

lwd = 2)

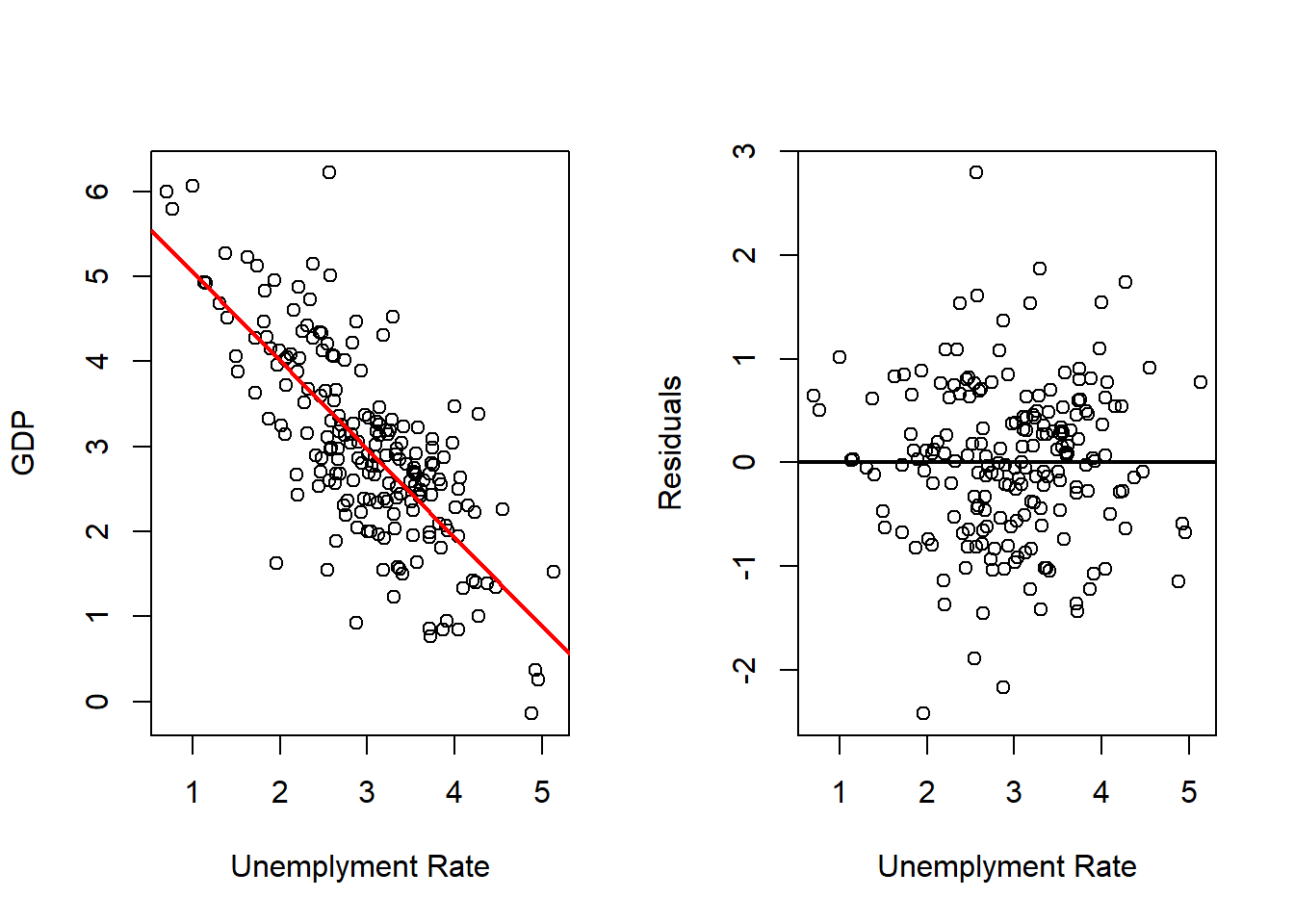

Unemployment Rate

# Fits with Unemployment

outRegUne <- lm(gdp ~ une, data = dat)

varVal <- dat$une

out <- outRegUne

varNam <- "Unemployment Rate"

# Plots Regression Line and Scatterplot and residuals plot

par(mfrow = c(1, 2))

plot(x = varVal,

y = dat$gd,

xlab = varNam,

ylab = "GDP",

pch = 16)

abline(a = out$coefficients[1],

b = out$coefficients[2],

col = 'red',

lwd = 2)

plot(x = varVal,

y = out$residuals,

xlab = varNam,

ylab = "Residuals",

pch = 16)

abline(h = 0,

lwd = 2)

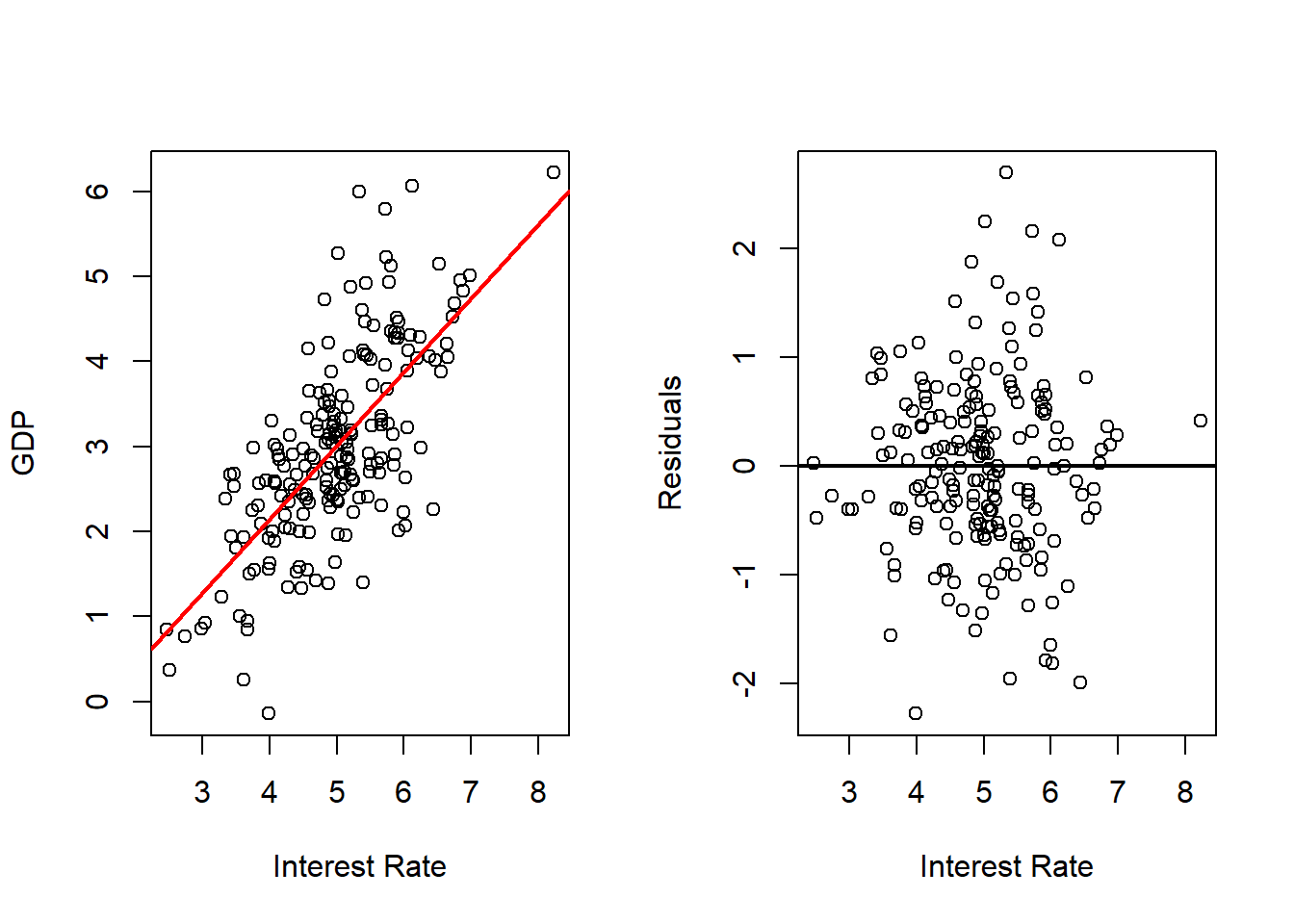

Interest Rate

# Fits with Interest Rate

outRegInt <- lm(gdp ~ int, data = dat)

varVal <- dat$int

out <- outRegInt

varNam <- "Interest Rate"

# Plots Regression Line and Scatterplot and residuals plot

par(mfrow = c(1, 2))

plot(x = varVal,

y = dat$gd,

xlab = varNam,

ylab = "GDP",

pch = 16)

abline(a = out$coefficients[1],

b = out$coefficients[2],

col = 'red',

lwd = 2)

plot(x = varVal,

y = out$residuals,

xlab = varNam,

ylab = "Residuals",

pch = 16)

abline(h = 0,

lwd = 2)

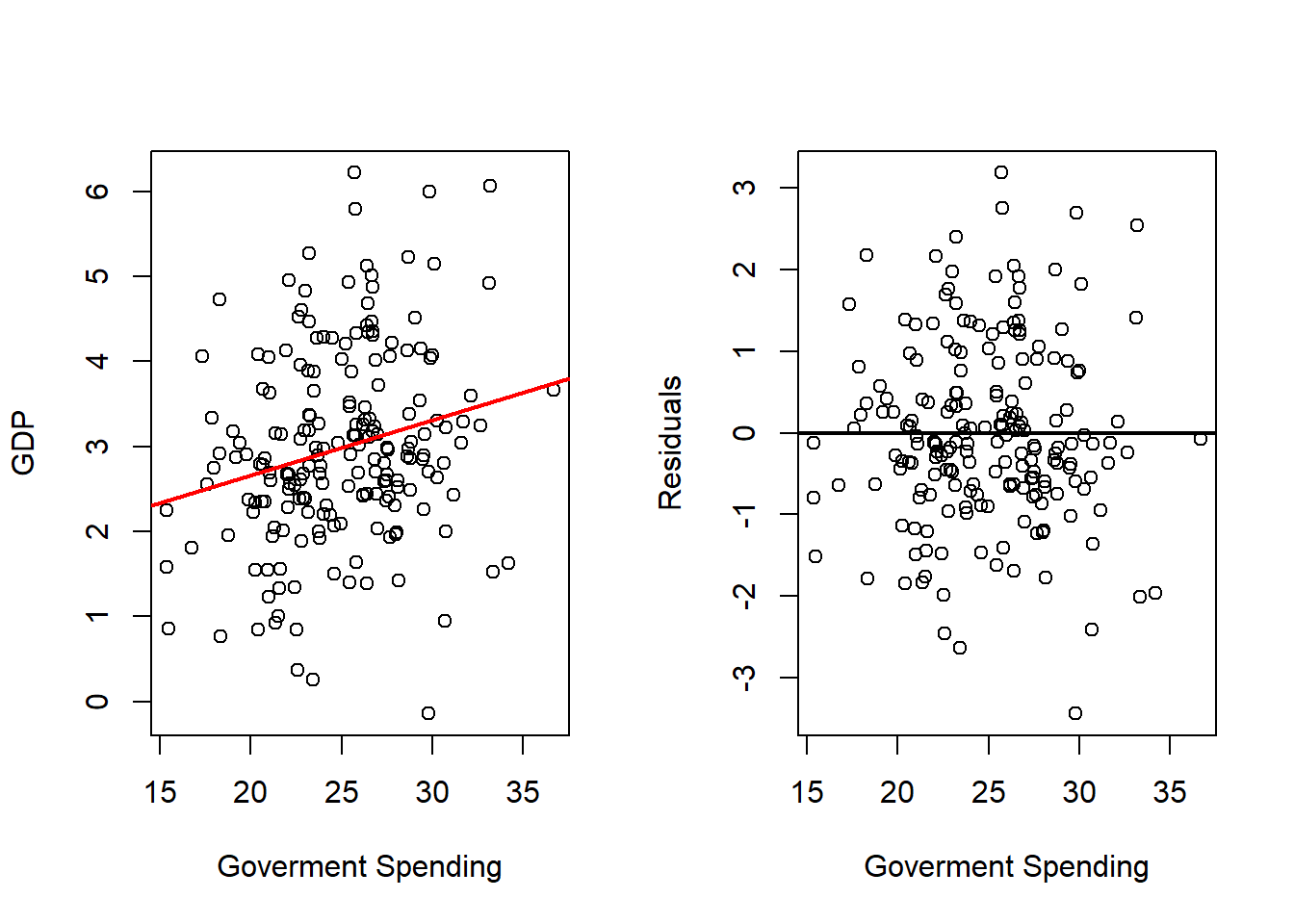

Government Spending

# Fits with Government Spending

outRegGov <- lm(gdp ~ gov, data = dat)

varVal <- dat$gov

out <- outRegGov

varNam <- "Government Spending"

# Plots Regression Line and Scatterplot and residuals plot

par(mfrow = c(1, 2))

plot(x = varVal,

y = dat$gd,

xlab = varNam,

ylab = "GDP",

pch = 16)

abline(a = out$coefficients[1],

b = out$coefficients[2],

col = 'red',

lwd = 2)

plot(x = varVal,

y = out$residuals,

xlab = varNam,

ylab = "Residuals",

pch = 16)

abline(h = 0,

lwd = 2)

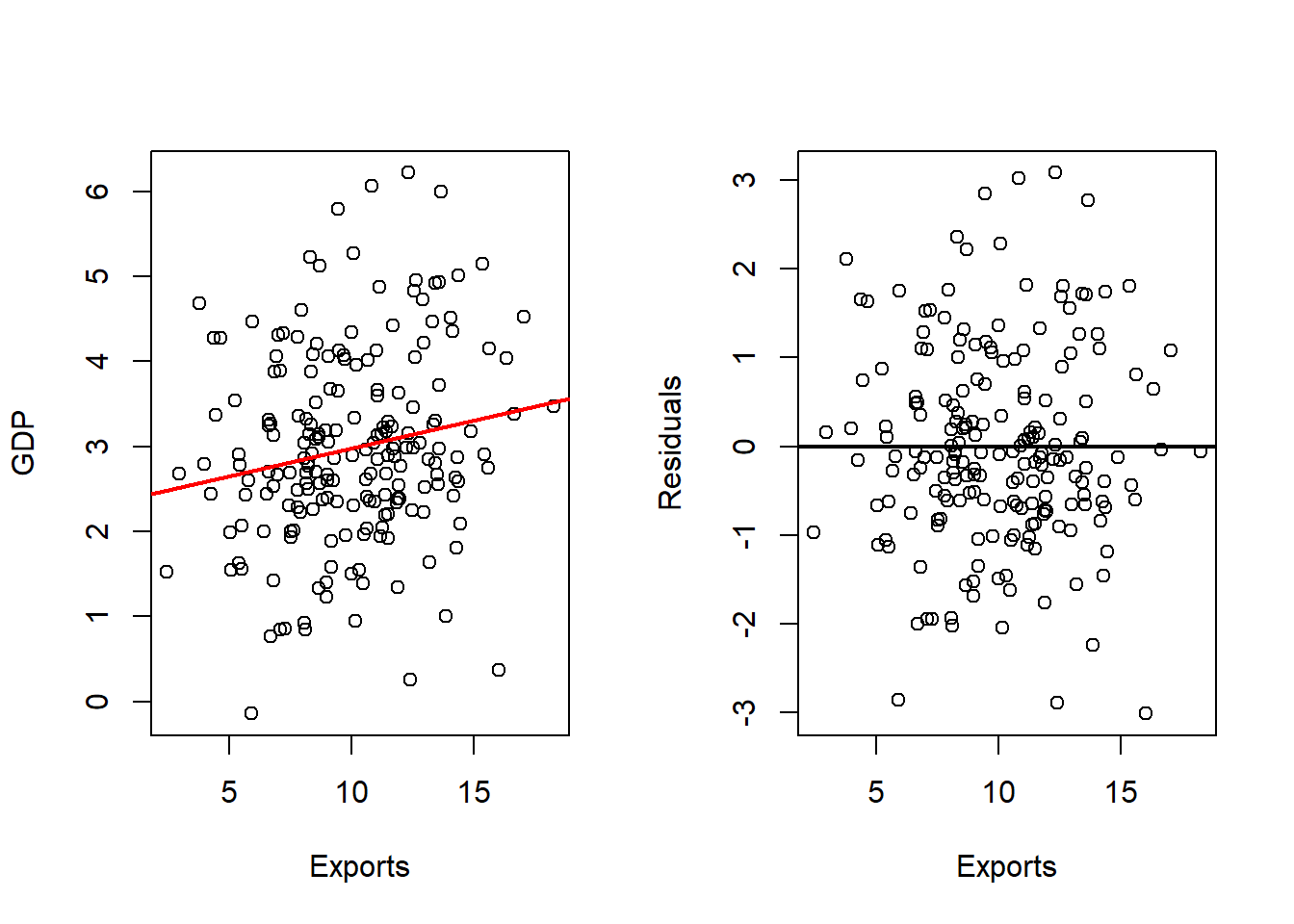

Exports

# Fits with Exports

outRegExp <- lm(gdp ~ exp, data = dat)

varVal <- dat$exp

out <- outRegExp

varNam <- "Exports"

# Plots Regression Line and Scatterplot and residuals plot

par(mfrow = c(1, 2))

plot(x = varVal,

y = dat$gd,

xlab = varNam,

ylab = "GDP",

pch = 16)

abline(a = out$coefficients[1],

b = out$coefficients[2],

col = 'red',

lwd = 2)

plot(x = varVal,

y = out$residuals,

xlab = varNam,

ylab = "Residuals",

pch = 16)

abline(h = 0,

lwd = 2)

6.2.2 Multiple Regression

Each variable individually shows some relationship with GDP, but the key advantage of multiple regression is that it considers all predictors simultaneously. This allows us to estimate the unique contribution of each factor while controlling for the others.

We fit the full model including all predictors:

outRegAll <- lm(gdp ~ inf + une + int + gov + exp, data = dat)

# Summary All

print("All Independent Variables")## [1] "All Independent Variables"##

## Call:

## lm(formula = gdp ~ inf + une + int + gov + exp, data = dat)

##

## Residuals:

## Min 1Q Median 3Q Max

## -1.56610 -0.38300 -0.00634 0.36630 1.22542

##

## Coefficients:

## Estimate Std. Error t value Pr(>|t|)

## (Intercept) 1.555301 0.380440 4.088 6.41e-05 ***

## inf 0.312218 0.090012 3.469 0.000647 ***

## une -0.377334 0.129275 -2.919 0.003938 **

## int 0.177827 0.128312 1.386 0.167403

## gov -0.008483 0.010361 -0.819 0.413950

## exp 0.064657 0.011930 5.420 1.80e-07 ***

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

##

## Residual standard error: 0.5024 on 190 degrees of freedom

## Multiple R-squared: 0.8096, Adjusted R-squared: 0.8046

## F-statistic: 161.6 on 5 and 190 DF, p-value: < 2.2e-16## [1] "Only Inflation Rate"##

## Call:

## lm(formula = gdp ~ inf, data = dat)

##

## Residuals:

## Min 1Q Median 3Q Max

## -1.40960 -0.38896 0.03562 0.37998 1.33364

##

## Coefficients:

## Estimate Std. Error t value Pr(>|t|)

## (Intercept) 1.02551 0.08705 11.78 <2e-16 ***

## inf 0.49489 0.01965 25.19 <2e-16 ***

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

##

## Residual standard error: 0.5514 on 194 degrees of freedom

## Multiple R-squared: 0.7659, Adjusted R-squared: 0.7646

## F-statistic: 634.5 on 1 and 194 DF, p-value: < 2.2e-16## [1] "Only Unemployment Rate"##

## Call:

## lm(formula = gdp ~ une, data = dat)

##

## Residuals:

## Min 1Q Median 3Q Max

## -2.42276 -0.49693 0.02667 0.49525 2.79562

##

## Coefficients:

## Estimate Std. Error t value Pr(>|t|)

## (Intercept) 6.0868 0.2046 29.74 <2e-16 ***

## une -1.0400 0.0661 -15.73 <2e-16 ***

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

##

## Residual standard error: 0.7554 on 194 degrees of freedom

## Multiple R-squared: 0.5606, Adjusted R-squared: 0.5584

## F-statistic: 247.5 on 1 and 194 DF, p-value: < 2.2e-16## [1] "Only Interest Rate"##

## Call:

## lm(formula = gdp ~ int, data = dat)

##

## Residuals:

## Min 1Q Median 3Q Max

## -2.27807 -0.50801 -0.00257 0.50336 2.69719

##

## Coefficients:

## Estimate Std. Error t value Pr(>|t|)

## (Intercept) -1.31600 0.32323 -4.071 6.8e-05 ***

## int 0.86483 0.06398 13.517 < 2e-16 ***

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

##

## Residual standard error: 0.8178 on 194 degrees of freedom

## Multiple R-squared: 0.485, Adjusted R-squared: 0.4824

## F-statistic: 182.7 on 1 and 194 DF, p-value: < 2.2e-16## [1] "Only Government Spending"##

## Call:

## lm(formula = gdp ~ gov, data = dat)

##

## Residuals:

## Min 1Q Median 3Q Max

## -3.4370 -0.6442 -0.1258 0.7429 3.1839

##

## Coefficients:

## Estimate Std. Error t value Pr(>|t|)

## (Intercept) 1.37117 0.51450 2.665 0.00835 **

## gov 0.06464 0.02041 3.167 0.00179 **

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

##

## Residual standard error: 1.111 on 194 degrees of freedom

## Multiple R-squared: 0.04916, Adjusted R-squared: 0.04426

## F-statistic: 10.03 on 1 and 194 DF, p-value: 0.001789## [1] "Only Exports"##

## Call:

## lm(formula = gdp ~ exp, data = dat)

##

## Residuals:

## Min 1Q Median 3Q Max

## -3.0084 -0.6679 -0.1133 0.6581 3.0810

##

## Coefficients:

## Estimate Std. Error t value Pr(>|t|)

## (Intercept) 2.32709 0.27818 8.365 1.16e-14 ***

## exp 0.06540 0.02664 2.455 0.015 *

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

##

## Residual standard error: 1.122 on 194 degrees of freedom

## Multiple R-squared: 0.03014, Adjusted R-squared: 0.02514

## F-statistic: 6.028 on 1 and 194 DF, p-value: 0.01496# Formats and Show Info Table

tab <- cbind(outRegAll$coefficients[-1], c(outRegInf$coefficients[2],

outRegUne$coefficients[2],

outRegInt$coefficients[2],

outRegGov$coefficients[2],

outRegExp$coefficients[2]))

colnames(tab) <- c("All", "Individual")

rownames(tab) <- c("Inflation", "Unemployment", "Interest Rate", "Government Expenditure", "Exports")

knitr::kable(tab)| All | Individual | |

|---|---|---|

| Inflation | 0.3122181 | 0.4948931 |

| Unemployment | -0.3773340 | -1.0400201 |

| Interest Rate | 0.1778271 | 0.8648348 |

| Government Expenditure | -0.0084833 | 0.0646403 |

| Exports | 0.0646569 | 0.0654039 |

Comparing the simple regressions with the multiple regression highlights an important point: coefficient estimates can change when predictors are analyzed jointly. In some cases, a variable may even change sign once other variables are included, which suggests potential multicollinearity or overlapping explanatory power. Such cases warrant further investigation.

6.2.3 Summary

This example illustrates the key steps in multiple regression analysis:

- Explore relationships through scatterplots and correlations.

- Fit simple regressions to understand individual effects.

- Fit the full multiple regression to assess joint contributions.

- Compare results to detect changes in coefficient estimates.

Multiple regression provides a richer, more realistic picture of how multiple factors influence an outcome, but it also requires careful interpretation and diagnostic checks.

6.3 Least Squares Estimation

For least squares estimation, we need to solve the problem:

\[ \min_\boldsymbol{\beta}Q(\boldsymbol{\beta}) = \sum_{i=1}^n (y_i - \hat{y}(\boldsymbol{\beta}))^2 = (\mathbf{y}- \hat{\mathbf{y}})'(\mathbf{y}- \hat{\mathbf{y}}) = (\mathbf{y}- \mathbf{X}\boldsymbol{\beta})'(\mathbf{y}- \mathbf{X}\boldsymbol{\beta}) \] The representation in matrix notation of the problem, allows us to use the same expression to solve this problem as with simple linear regression. The solution is obtained in the exact same way, and is given by:

\[ \hat{\boldsymbol{\beta}} = (\mathbf{X}' \mathbf{X})^{-1}\mathbf{X}'\mathbf{y} \] however in this case:

\[ \hat{\boldsymbol{\beta}} = \left(\hat{\beta}_0, \hat{\beta}_1, \hat{\beta}_2,\ldots,\hat{\beta}_p\right)' \] this is the reason, working in matrix form is very useful.

6.4 Properties of the Estimates

As with simple linear regression, we can consider several estimates:

- \(\hat{\mathbf{y}} = \mathbf{X}\boldsymbol{\beta}\) the estimates of the observations,

- \(\hat{\mathbf{e}} = \mathbf{y}- \hat{\mathbf{y}} = \mathbf{y}- \mathbf{X}\hat{\boldsymbol{\beta}}\) the estimates of the errors.

We also note that:

\[ \hat{\mathbf{y}} = \mathbf{X}(\mathbf{X}'\mathbf{X})^{-1}\mathbf{X}' \mathbf{y}= \mathbf{H}y \] where \(\mathbf{H}\) is called the hat matrix, because it transforms \(\mathbf{y}\) into \(\hat{\mathbf{y}}\), or the projection matrix.

We will see that:

- \(\hat{\boldsymbol{\beta}}\) is a linear combination of \(y\).

- The sum of the estimated errors is equal to zero, \(\sum_{i=1}^n \hat{e_i} = 0\).

- \(\hat{\mathbf{e}}\) and \(\hat{\mathbf{x}_j}\) are orthogonal for \(j=\{1,\ldots,p\}\).

- \(\hat{\mathbf{e}}\) and \(\hat{\mathbf{y}}\) are orthogonal.

- \(\bar{y} = \hat{\bar{y}}\).

To see that \(\hat{\boldsymbol{\beta}}\) is a linear combination of \(y\), we need to express \(\hat{\boldsymbol{\beta}}\) as follows:

\[ \hat{\boldsymbol{\beta}} = \mathbf{A}\mathbf{y} \]

for some matrix \(\mathbf{A}\). This is very easy to do, we just let \(\mathbf{A}= (\mathbf{X}'\mathbf{X})^{-1}\mathbf{X}'\), so:

\[ \hat{\boldsymbol{\beta}} = (\mathbf{X}'\mathbf{X})^{-1}\mathbf{X}'\mathbf{y}= \mathbf{A}\mathbf{y} \] Now to see that the sum of the estimated errors is equal to zero, \(\sum_{i=1}^n \hat{e_i} = 0\), we notice that we need to show that:

\[ \hat{\mathbf{e}}' \mathbf{1}= 0 \]

To do so we notice that:

\[\begin{align*} \hat{\boldsymbol{\beta}} = (\mathbf{X}'\mathbf{X})^{-1}\mathbf{X}'\mathbf{y} &\implies (\mathbf{X}'\mathbf{X})\hat{\boldsymbol{\beta}} = \mathbf{X}'\mathbf{y}\\ &\implies \mathbf{X}'\mathbf{y}- \mathbf{X}'\mathbf{X}\hat{\boldsymbol{\beta}} = \mathbf{0}\\ &\implies \mathbf{X}'\left(\mathbf{y}- \hat{\mathbf{y}}\right) = \mathbf{0}\\ &\implies \mathbf{X}'\hat{\mathbf{e}} = \mathbf{0} \end{align*}\]

Now focusing on the product \(\mathbf{X}'\hat{\mathbf{e}}\) we have that:

\[ \mathbf{X}'\hat{\mathbf{e}} = \left[\begin{matrix} \mathbf{1}' \\ \mathbf{x}_1 \\ \mathbf{x}_2 \\ \vdots \\ \mathbf{x}_p \end{matrix}\right] \hat{\mathbf{e}} = \left[\begin{matrix} \mathbf{1}' \hat{\mathbf{e}} \\ \mathbf{x}_1 \hat{\mathbf{e}} \\ \mathbf{x}_2 \hat{\mathbf{e}} \\ \vdots \\ \mathbf{x}_p \hat{\mathbf{e}} \end{matrix}\right] \] So we have that:

\[ \left[\begin{matrix} \mathbf{1}' \hat{\mathbf{e}} \\ \mathbf{x}_1 \hat{\mathbf{e}} \\ \mathbf{x}_2 \hat{\mathbf{e}} \\ \vdots \\ \mathbf{x}_p \hat{\mathbf{e}} \end{matrix}\right] = \left[\begin{matrix} 0 \\ 0 \\ 0 \\ \vdots \\ 0 \end{matrix}\right] \] So from the first line of this result, we have that:

\[ \mathbf{1}' \hat{\mathbf{e}} = 0 \] which is the result we wanted to proof.

Now, to show that \(\hat{\mathbf{e}}\) and \(\hat{\mathbf{x}_j}\) are orthogonal for \(j=\{1,\ldots,p\}\), we use again on:

\[ \left[\begin{matrix} \mathbf{1}' \hat{\mathbf{e}} \\ \mathbf{x}_1 \hat{\mathbf{e}} \\ \mathbf{x}_2 \hat{\mathbf{e}} \\ \vdots \\ \mathbf{x}_p \hat{\mathbf{e}} \end{matrix}\right] = \left[\begin{matrix} 0 \\ 0 \\ 0 \\ \vdots \\ 0 \end{matrix}\right] \]

And notice that lines 2 to \(p+1\) proof this results, that is

\[ \mathbf{x}_i ' \hat{\mathbf{e}} = 0 \quad i=\{1,\ldots,p\} \] Now to show that \(\hat{\mathbf{e}}\) and \(\hat{\mathbf{y}}\) are orthogonal, we show that:

\[ \hat{\mathbf{e}}'\hat{\mathbf{y}} = 0 \] Now

\[\begin{align*} \hat{\mathbf{e}}'\hat{\mathbf{y}} &= (\mathbf{y}- \hat{\mathbf{y}})'\hat{\mathbf{y}} \\ &= \left(\mathbf{y}- \mathbf{X}\hat{\boldsymbol{\beta}}\right)'\mathbf{X}\hat{\boldsymbol{\beta}} \\ &= \left(\mathbf{y}- \mathbf{X}(\mathbf{X}'\mathbf{X})^{-1}\mathbf{X}'\mathbf{y}\right)'\mathbf{X}(\mathbf{X}'\mathbf{X})^{-1}\mathbf{X}'\mathbf{y}\\ &= \mathbf{y}' \mathbf{X}(\mathbf{X}'\mathbf{X})^{-1}\mathbf{X}'\mathbf{y}- \mathbf{y}' \mathbf{X}(\mathbf{X}'\mathbf{X})^{-1}\mathbf{X}' \mathbf{X}(\mathbf{X}'\mathbf{X})^{-1}\mathbf{X}' \mathbf{y}\\ &= \mathbf{y}' \mathbf{X}(\mathbf{X}'\mathbf{X})^{-1}\mathbf{X}'\mathbf{y}- \mathbf{y}' \mathbf{X}(\mathbf{X}'\mathbf{X})^{-1}\mathbf{X}' \mathbf{y}\\ &= 0 \end{align*}\]

Finally, to show that \(\bar{y} = \hat{\bar{y}}\), we use:

\[ \hat{\mathbf{e}}'\mathbf{1}= (\mathbf{y}- \hat{\mathbf{y}})'\mathbf{1}= \mathbf{y}'\mathbf{1}- \hat{\mathbf{y}}'\mathbf{1}= \sum_{i=1}^ny_i - \sum_{i=1}^n\hat{y}_i = n\bar{y} - n\hat{\bar{y}} \] since \(\hat{\mathbf{e}}'\mathbf{1}= 0\), then we have that

\[ n\bar{y} - n\hat{\bar{y}} = 0 \implies n\bar{y} = n\hat{\bar{y}} \implies \bar{y} = \hat{\bar{y}} \]

6.5 Multiple \(R^2\)

As with simple linear regression we can explain the total variability, by decomposing the variability in two parts, the regression variability and the error variability.

First, we define this concepts:

Total Sum of Squares \(SS_{tot}\):

The total sum of squares measures the total variability in \(\mathbf{y}\):\[ SS_{tot} = (\mathbf{y} - \bar{y} \mathbf{1})' (\mathbf{y} - \bar{y} \mathbf{1}) \]

Residual Sum of Squares \(SS_{res}\):

The residual sum of squares measures the unexplained variability in the regression model:\[ SS_{res} = (\mathbf{y} - \hat{\mathbf{y}})' (\mathbf{y} - \hat{\mathbf{y}}) \]

Explained Sum of Squares \(SS_{reg}\)

The explained sum of squares measures how much of the total variability is explained by the regression model. It is the difference between the predicted values and the mean of \(\mathbf{y}\):

\[ SS_{reg} = (\hat{\mathbf{y}} - \bar{y} \mathbf{1})' (\hat{\mathbf{y}} - \bar{y} \mathbf{1}) \] As with simple linear regression, it can be shown that:

\[ SS_{tot} = SS_{reg} + SS_{res} \] To see this, we start form \(SS_{tot}\), and do the adding and subtracting trick:

\[\begin{align*} SS_{tot} &= (\mathbf{y} - \bar{y} \mathbf{1})' (\mathbf{y} - \bar{y} \mathbf{1}) \\ &= (\mathbf{y} - \hat{\mathbf{y}} + \hat{\mathbf{y}} - \bar{y} \mathbf{1})' (\mathbf{y} - \hat{\mathbf{y}} + \hat{\mathbf{y}} - \bar{y} \mathbf{1}) \\ &= (\mathbf{y} - \hat{\mathbf{y}})' (\mathbf{y} - \hat{\mathbf{y}}) + (\mathbf{y} - \hat{\mathbf{y}})' (\hat{\mathbf{y}} - \bar{y} \mathbf{1}) + (\hat{\mathbf{y}} - \bar{y} \mathbf{1})' (\mathbf{y} - \hat{\mathbf{y}}\mathbf{1}) + (\hat{\mathbf{y}} - \bar{y} \mathbf{1})' (\hat{\mathbf{y}} - \bar{y} \mathbf{1}) \end{align*}\]

Now, notice that:

\[ (\mathbf{y} - \hat{\mathbf{y}})' (\hat{\mathbf{y}} - \bar{y} \mathbf{1}) = \hat{\mathbf{e}}' (\hat{\mathbf{y}} - \bar{y} \mathbf{1}) = \hat{\mathbf{e}}'\hat{\mathbf{y}} - \bar{y}\hat{\mathbf{e}}' \mathbf{1} = 0 - \bar{y}0 = 0 \] And similarly for \((\hat{\mathbf{y}} - \bar{y} \mathbf{1})' (\mathbf{y} - \hat{\mathbf{y}}\mathbf{1}) = 0\), then:

\[ SS_{tot} = (\mathbf{y} - \hat{\mathbf{y}})' (\mathbf{y} - \hat{\mathbf{y}}) + (\hat{\mathbf{y}} - \bar{y} \mathbf{1})' (\hat{\mathbf{y}} - \bar{y} \mathbf{1}) = SS_{reg} + SS_{res} \] The multiple \(R^2\) is the variability explained by the regression with respect to the total variability and can be expressed as:

\[ R^2 = \frac{SS_{reg}}{SS_{tot}} \] or using the previous expression

\[ 1 = \frac{SS_{tot}}{SS_{tot}} = \frac{SS_{reg}}{SS_{tot}} + \frac{SS_{res}}{SS_{tot}} = R^2 + \frac{SS_{res}}{SS_{tot}} \implies R^2 = 1 - \frac{SS_{res}}{SS_{tot}} \]

Finally, we work on the expressions of \(SS_{res}\) and \(SS_{tot}\), to express them in terms of projection matrices.

First note that:

\[ \mathbf{y}- \hat{\mathbf{y}} = \mathbf{y}- \mathbf{X}\hat{\boldsymbol{\beta}} = \mathbf{y}- \mathbf{H}\mathbf{y}= (\mathbf{I}- \mathbf{H})\mathbf{y} \] and also notice that \((\mathbf{I}- \mathbf{H})\) is symmetric and:

\[ (\mathbf{I}- \mathbf{H})(\mathbf{I}- \mathbf{H}) = \mathbf{I}-\mathbf{H}- \mathbf{H}+ \mathbf{H}\mathbf{H} \] and

\[ \mathbf{H}\mathbf{H}= \mathbf{X}(\mathbf{X}'\mathbf{X})^{-1}\mathbf{X}' \mathbf{X}(\mathbf{X}'\mathbf{X})^{-1}\mathbf{X}' = \mathbf{X}(\mathbf{X}'\mathbf{X})^{-1}\mathbf{X}' = \mathbf{H} \] this means \(\mathbf{H}\) is idempotent. In fact, all projection matrices are idempotent.

Then, we have that:

\[ (\mathbf{I}- \mathbf{H})(\mathbf{I}- \mathbf{H}) = \mathbf{I}-\mathbf{H}- \mathbf{H}+ \mathbf{H}= \mathbf{I}-\mathbf{H}- \mathbf{H} \] which makes \(\mathbf{I}- \mathbf{H}\) also idempotent. Therefore:

\[ SS_{res} = (\mathbf{y}- \hat{\mathbf{y}})'(\mathbf{y}- \hat{\mathbf{y}}) = ((\mathbf{I}- \mathbf{H})\mathbf{y})'((\mathbf{I}- \mathbf{H})\mathbf{y}) = \mathbf{y}'(\mathbf{I}- \mathbf{H})'(\mathbf{I}- \mathbf{H})\mathbf{y}= \mathbf{y}'(\mathbf{I}- \mathbf{H})\mathbf{y} \] And we can do a similar trick for the \(SS_{tot}\) by writing \(\bar{y} \mathbf{1}\) as a result of projecting \(\mathbf{y}\) with a design matrix \(\mathbf{1}\):

\[ \bar{y} \mathbf{1}= \mathbf{1}\bar{y} = \mathbf{1}\frac{1}{n} \sum_{i=1}^n y_i = \mathbf{1}\frac{1}{n}\mathbf{1}' \mathbf{y}= \mathbf{1}(\mathbf{1}'\mathbf{1})^{-1}\mathbf{1}' \mathbf{y} \] where we use the fact that \(\mathbf{1}'\mathbf{1}= n\).

We call \(\mathbf{H}_0 = \mathbf{1}(\mathbf{1}'\mathbf{1})^{-1}\mathbf{1}'\), since \(\mathbf{1}(\mathbf{1}'\mathbf{1})^{-1}\mathbf{1}'\) is a projection matrix. And since it is a projection matrix it is idempotent (it is also not difficult to check this manually) and \(\mathbf{I}- \mathbf{H}_0\) is also idempotent.

So we can do:

\[ \mathbf{y}- \hat{y}\mathbf{1}= \mathbf{y}- \mathbf{H}_0 \mathbf{y}= (\mathbf{I}-\mathbf{H}_0)\mathbf{y} \]

\[ SS_{tot} = (\mathbf{y}- \bar{y}\mathbf{1})'(\mathbf{y}- \bar{y}\mathbf{1}) = ((\mathbf{I}- \mathbf{H}_0)\mathbf{y})'((\mathbf{I}- \mathbf{H}_0)\mathbf{y}) = \mathbf{y}'(\mathbf{I}- \mathbf{H}_0)'(\mathbf{I}- \mathbf{H}_0)\mathbf{y}= \mathbf{y}'(\mathbf{I}- \mathbf{H}_0)\mathbf{y} \]

so the \(R^2\) can be expressed as follows:

\[ R^2 = 1 - \frac{\mathbf{y}'(\mathbf{I}- \mathbf{H})\mathbf{y}}{\mathbf{y}'(\mathbf{I}- \mathbf{H}_0)\mathbf{y}} \] When written like this, it is easy to see that:

\[ \mathbf{y}'(\mathbf{I}- \mathbf{H})\mathbf{y}= \min_\boldsymbol{\beta}(\mathbf{y}- \mathbf{X}\boldsymbol{\beta})'(\mathbf{y}- \mathbf{X}\boldsymbol{\beta}) \] the solution to this minimization problem, since we are using the optimal value \(\hat{\boldsymbol{\beta}}\). And

\[ \mathbf{y}'(\mathbf{I}- \mathbf{H}_0)\mathbf{y}= \min_{\beta_0} (\mathbf{y}- \mathbf{X}_0 \beta_0)'(\mathbf{y}- \mathbf{X}_0 \beta_0) \]

where \(\mathbf{X}_0\) is just a matrix with one column \(\mathbf{1}\).

Now, we also have that:

\[ \min_\boldsymbol{\beta}(\mathbf{y}- \mathbf{X}\boldsymbol{\beta})'(\mathbf{y}- \mathbf{X}\boldsymbol{\beta}) \leq \min_{\beta_0} (\mathbf{y}- \mathbf{X}_0 \beta_0)'(\mathbf{y}- \mathbf{X}_0 \beta_0) \]

therefore

\[ \mathbf{y}'(\mathbf{I}- \mathbf{H})\mathbf{y}\leq \mathbf{y}'(\mathbf{I}- \mathbf{H}_0)\mathbf{y} \] and since both of them are quadratic forms, we have that:

\(\mathbf{y}'(\mathbf{I}- \mathbf{H}_0)\mathbf{y}, \mathbf{y}'(\mathbf{I}- \mathbf{H})\mathbf{y}\geq 0\)

then:

\[0 \leq \frac{\mathbf{y}'(\mathbf{I}- \mathbf{H})\mathbf{y}}{\mathbf{y}'(\mathbf{I}- \mathbf{H}_0)\mathbf{y}} \leq 0\] then:

\[0 \leq R^2 \leq 0\].

Where we use the fact that all symmetric idempotent matrices are symmetric positive semi-definite.

Another interpretation of \(R^2\) is the percentage of the variability explained by multiple regression of a “poor man’s regression” in which you don’t have independent variables (that is you are independent variable poor). In this way, we can define

\[ \bar{y} \mathbf{1}= \hat{\mathbf{y}}_0 \] the “poor man’s prediction”, of which \(\mathbf{H}_0\) is it’s projection matrix (or hat matrix).

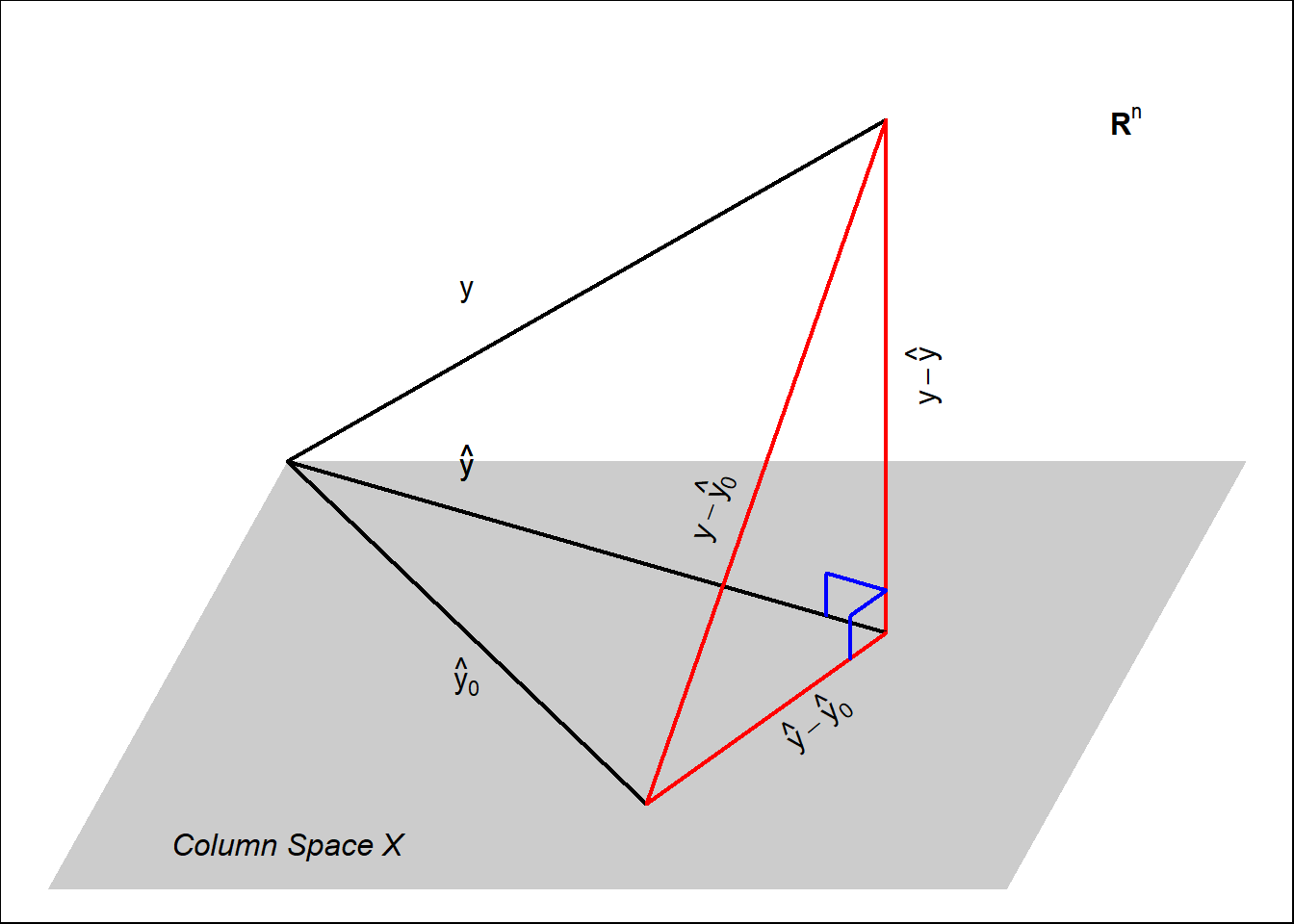

6.6 Geometric Interpretation of Multiple Linear Regression

Multiple linear regression can be thought as projecting \(\mathbf{y}\) in the column space of the design matrix \(\mathbf{X}\). The following diagram pictures multiple linear regression.

Here we can see several components:

- \(\mathbf{y}\) is the vector of observations. Is a vector in \(\mathbb{R}^n\).

- The grey hyper-plane is the column space generated by \(\mathbf{X}\), a sub-space of \(\mathbb{R}^n\).

- The multiple regression prediction \(\hat{\mathbf{y}}\) of \(\mathbf{y}\) is the projection of \(\mathbf{y}\) on the space generated by the column of \(\mathbf{X}\).

- The poor man’s prediction \(\hat{\mathbf{y}}_0\), in the column space of \(\mathbf{X}\) (since, one of the columns is \(\mathbf{1}\)), but in most cases it is different to \(\hat{\mathbf{y}}\) (the closest vector in the column space of \(\mathbf{X}\) to \(\mathbf{y}\)).

- We notice that the differences:

- \(\mathbf{y}- \hat{\mathbf{y}}\).

- \(\mathbf{y}- \hat{\mathbf{y}}_0\)

- \(\hat{\mathbf{y}} - \hat{\mathbf{y}}_0\)

6.7 Centered and Standarized Variables

6.7.1 Centered Variables

Like with simple linear regression we can center and standardize our variables.

For this section, let us use the notation:

\[\mathbf{X}= \left[\mathbf{x}_1, \mathbf{x}_2, \ldots \mathbf{x}_p \right]\] a matrix with \(p\) variables in which each column is a variable \(\mathbf{x}_i\). In the context of linear regression you can this is similar to the design matrix except that it doesn’t have the column of ones. In this way, we will rename the design matrix as

\[\mathbf{X}_{*} = \left[\mathbf{1}\mathbf{X}\right] \] we introduce this notation, since we don’t want to center or standardize the column of ones.

To center matrix \(\mathbf{X}\) we need to remove the mean of every column. Notice that the vector of means is given by:

\[\bar{\mathbf{x}} = \left[\begin{matrix} \bar{\mathbf{x}}_1 \\ \bar{\mathbf{x}}_2 \\ \vdots \\ \bar{\mathbf{x}}_p \end{matrix}\right] = \left[\begin{matrix} \frac{1}{n} \mathbf{x}_1'\mathbf{1}\\ \frac{1}{n} \mathbf{x}_2'\mathbf{1}\\ \vdots \\ \frac{1}{n} \mathbf{x}_p'\mathbf{1} \end{matrix}\right] = \frac{1}{n} \left[\begin{matrix} \mathbf{x}_1'\mathbf{1}\\ \mathbf{x}_2'\mathbf{1}\\ \vdots \\ \mathbf{x}_p'\mathbf{1} \end{matrix}\right] = \frac{1}{n} \mathbf{X}' \mathbf{1}\]

then the centered data \(\mathbf{X}_c\) is given by:

\[\mathbf{X}_c = \mathbf{X}- \left[\begin{matrix} \bar{\mathbf{x}}_1 & \bar{\mathbf{x}}_2 & \dots & \bar{\mathbf{x}}_p\\ \bar{\mathbf{x}}_1 & \bar{\mathbf{x}}_2 & \dots & \bar{\mathbf{x}}_p\\ \vdots & \vdots & \ddots & \vdots \\ \bar{\mathbf{x}}_1 & \bar{\mathbf{x}}_2 & \dots & \bar{\mathbf{x}}_p \end{matrix}\right] = \mathbf{X}- \mathbf{1}\bar{\mathbf{x}}' = \mathbf{X}- \mathbf{1}\left(\frac{1}{n} \mathbf{X}' \mathbf{1}\right)' = \mathbf{X}- \frac{1}{n}\mathbf{1}\mathbf{1}' \mathbf{X}= \left(\mathbf{I}- \frac{1}{n}\mathbf{1}\mathbf{1}' \right)\mathbf{X}\]

We call \[\mathbf{C}= \left(\mathbf{I}- \frac{1}{n}\mathbf{1}\mathbf{1}' \right) = \mathbf{I}- \mathbf{H}_0 \] the centering matrix, since it centers the variables of matrix \(\mathbf{X}\). Note also, that \(\mathbf{C}\) also centers any matrix with \(n\) rows, in particular a vector of size \(n\) is also centered by \(\mathbf{C}\). So we can center \(y\) the dependent variable, the same way:

\[\mathbf{y}_c = \mathbf{C}\mathbf{y}\]

6.7.2 Sample Covariance

Having defined, the centered matrix \(\mathbf{X}_c\) we can define the sample covariance of \(\mathbf{X}\), \(\mathbf{S}_{XX} \in \mathbb{R}^{p \times p}\) as follows:

\[ \mathbf{S}_{XX} = \frac{1}{n-1} \left(\mathbf{X}- \mathbf{1}\bar{\mathbf{x}}'\right)'\left(\mathbf{X}- \mathbf{1}\bar{\mathbf{x}}'\right) = \frac{1}{n-1} \mathbf{X}_c'\mathbf{X}_c = \frac{1}{n-1} \mathbf{X}'\mathbf{C}' \mathbf{C}\mathbf{X}\] Now, since \(\mathbf{C}= \mathbf{I}- \mathbf{H}_0\) is idempotent and symmetric we have that:

\[ \mathbf{S}_{XX} = \frac{1}{n-1} \mathbf{X}'\mathbf{C}' \mathbf{C}\mathbf{X}= \frac{1}{n-1} \mathbf{X}' \mathbf{C}\mathbf{X}= \frac{1}{n-1} \mathbf{X}_c'\mathbf{X}= \frac{1}{n-1} \mathbf{X}'\mathbf{X}_c \] So the sample covariance, is the same for the original variables and the centered variables.

We can also define the covariance vector between variables \(\mathbf{x}_1, \mathbf{x}_2, \ldots \mathbf{x}_p\) and variable \(\mathbf{y}\), \(\mathbf{S}_{Xy} \in \mathbb{R}^{p \times 1}\), as follows:

\[ \mathbf{S}_{Xy} = \frac{1}{n-1} \left(\mathbf{X}- \mathbf{1}\bar{\mathbf{x}}'\right)'\left(\mathbf{y}- \mathbf{1}\bar{y}\right) = \frac{1}{n-1} \mathbf{X}_c'\mathbf{y}_c = \frac{1}{n-1} \mathbf{X}'\mathbf{C}' \mathbf{C}\mathbf{y}\]

and, in the same way than before, we have that:

\[\mathbf{S}_{Xy} = \frac{1}{n-1} \mathbf{X}' \mathbf{C}' \mathbf{C}\mathbf{y}= \frac{1}{n-1} \mathbf{X}' \mathbf{C}\mathbf{y}= \frac{1}{n-1} \mathbf{X}_c'\mathbf{y}= \frac{1}{n-1} \mathbf{X}'\mathbf{y}_c\]

so, you don’t need to center both variables. As long as you center one of them the result will be the same.

With this measures, we can focus on splitting the vector of estimated coefficients \(\hat{\boldsymbol{\beta}}\), into the estimate for the intercept and the estimates for the independent variables, as follows:

\[\hat{\boldsymbol{\beta}} = \left[\begin{matrix} \hat{\beta}_0 \\ \hat{\boldsymbol{\beta}}_{-0} \end{matrix}\right]\]

with \(\hat{\beta}_0\) the estimate of the intercept and \(\hat{\boldsymbol{\beta}}_{-0}\) the coefficients for all independent variables. That is:

\[\hat{\boldsymbol{\beta}}_{-0} = \left[\begin{matrix} \hat{\beta}_1 \\ \hat{\beta}_2 \\ \vdots \\ \hat{\beta}_p \end{matrix}\right] \in \mathbb{R}^{p \times 1}\]

Under the new notation, \(\mathbf{X}_{*}\) for the design matrix, we have that:

\[ \hat{\boldsymbol{\beta}} = \left(\mathbf{X}_{*}'\mathbf{X}_{*}\right)^{-1}\mathbf{X}_{*}'\mathbf{y}\] so:

\[ \hat{\boldsymbol{\beta}} = \left[\begin{matrix} \hat{\beta}_0 \\ \hat{\boldsymbol{\beta}}_{-0} \end{matrix}\right] = \left( \left[\mathbf{1}\mathbf{X}\right]' \left[\mathbf{1}\mathbf{X}\right] \right)^{-1} \left[\mathbf{1}\mathbf{X}\right]' \mathbf{y}\]

so we need to compute \(\left( \left[\mathbf{1}\mathbf{X}\right]' \left[\mathbf{1}\mathbf{X}\right] \right)^{-1}\).

We start by computing:

\[\left[\mathbf{1}\mathbf{X}\right]' \left[\mathbf{1}\mathbf{X}\right] = \left[\begin{matrix} \mathbf{1}' \\ \mathbf{X}' \end{matrix}\right] \left[\mathbf{1}\mathbf{X}\right] = \left[\begin{matrix} \mathbf{1}' \mathbf{1}& \mathbf{1}' \mathbf{X}\\ \mathbf{X}'\mathbf{1}& \mathbf{X}' \mathbf{X}' \end{matrix}\right] = \left[\begin{matrix} n & n\bar{\mathbf{x}}' \\ n\bar{\mathbf{x}} & \mathbf{X}' \mathbf{X}' \end{matrix}\right] \] Now, we need to invert a 2 by 2 block matrix (luckily there is a formula for this). The formula is in the prerequisites section, however note that in this case one of the blocks is of height 1, since the first value we are looking for \(\hat{\beta}_0\) is a scalar. After applying the formula, we have:

\[\begin{align*} \left( \left[\mathbf{1}\mathbf{X}\right]' \left[\mathbf{1}\mathbf{X}\right] \right)^{-1} &= \left[\begin{matrix} n^{-1} + n^{-1} n\bar{\mathbf{x}}' \left(\mathbf{X}' \mathbf{X}' - n\bar{\mathbf{x}} n^{-1} n\bar{\mathbf{x}}' \right)^{-1}n\bar{\mathbf{x}} n^{-1} & -n^{-1} n\bar{\mathbf{x}}' \left(\mathbf{X}' \mathbf{X}' - n\bar{\mathbf{x}} n^{-1} n\bar{\mathbf{x}}' \right)^{-1} \\ -\left(\mathbf{X}' \mathbf{X}' - n\bar{\mathbf{x}} n^{-1} n\bar{\mathbf{x}}' \right)^{-1}n\bar{\mathbf{x}} n^{-1} & \left(\mathbf{X}' \mathbf{X}' - n\bar{\mathbf{x}} n^{-1} n\bar{\mathbf{x}}' \right)^{-1} \end{matrix}\right] \\ &= \left[\begin{matrix} n^{-1} + \bar{\mathbf{x}}' \left(\mathbf{X}' \mathbf{X}- n\bar{\mathbf{x}}\bar{\mathbf{x}}' \right)^{-1}\bar{\mathbf{x}} & \bar{\mathbf{x}}' \left(\mathbf{X}' \mathbf{X}- n\bar{\mathbf{x}} \bar{\mathbf{x}}' \right)^{-1} \\ -\left(\mathbf{X}' \mathbf{X}- n\bar{\mathbf{x}} \bar{\mathbf{x}}' \right)^{-1}\bar{\mathbf{x}} & \left(\mathbf{X}' \mathbf{X}- n\bar{\mathbf{x}} \bar{\mathbf{x}}' \right)^{-1} \end{matrix}\right] \end{align*}\]

Now, notice that:

\[\begin{align*} \mathbf{X}' \mathbf{X}- n\bar{\mathbf{x}} \bar{\mathbf{x}}' &= \mathbf{X}' \mathbf{X}- n\left(\frac{\mathbf{X}'\mathbf{1}}{n}\right)\left(\frac{\mathbf{X}'\mathbf{1}}{n}\right)' \\ &= \mathbf{X}' \mathbf{X}- \frac{1}{n}\mathbf{X}'\mathbf{1}\mathbf{1}' \mathbf{X}\\ &= \mathbf{X}'\left(\mathbf{I}- \frac{1}{n}\mathbf{1}\mathbf{1}'\right) \mathbf{X}\\ &= \mathbf{X}'\mathbf{C}\mathbf{X}\\ &= (n-1)\mathbf{S}_{XX} \end{align*}\]

then:

\[\begin{align*} \left( \left[\mathbf{1}\mathbf{X}\right]' \left[\mathbf{1}\mathbf{X}\right] \right)^{-1} &= \left[\begin{matrix} n^{-1} + \bar{\mathbf{x}}' \left((n-1)\mathbf{S}_{XX} \right)^{-1}\bar{\mathbf{x}} & -\bar{\mathbf{x}}' \left((n-1)\mathbf{S}_{XX} \right)^{-1} \\ -\left((n-1)\mathbf{S}_{XX} \right)^{-1}\bar{\mathbf{x}} & \left((n-1)\mathbf{S}_{XX} \right)^{-1} \end{matrix}\right] \\ &= \left[\begin{matrix} n^{-1} + \frac{1}{n-1}\bar{\mathbf{x}}' \mathbf{S}_{XX}^{-1} \bar{\mathbf{x}} & -\frac{1}{n-1}\bar{\mathbf{x}}' \mathbf{S}_{XX}^{-1} \\ -\frac{1}{n-1}\mathbf{S}_{XX}^{-1} \bar{\mathbf{x}} & \frac{1}{n-1}\mathbf{S}_{XX}^{-1} \end{matrix}\right] \end{align*}\]

In a similar way we can easily compute:

\[\left[\mathbf{1}\mathbf{X}\right]' \mathbf{y}= \left[\begin{matrix} \mathbf{1}' \mathbf{y}\\ \mathbf{X}'\mathbf{y} \end{matrix}\right] = \left[\begin{matrix} n\bar{y} \\ \mathbf{X}'\mathbf{y} \end{matrix}\right]\]

Then, we have that:

\[\begin{align*} \hat{\boldsymbol{\beta}} &= \left[\begin{matrix} \\ \hat{\beta}_0 \\ \hat{\boldsymbol{\beta}}_{-0} \end{matrix}\right] \\ &= \left[\begin{matrix} n^{-1} + \frac{1}{n-1}\bar{\mathbf{x}}' \mathbf{S}_{XX}^{-1} \bar{\mathbf{x}} & -\frac{1}{n-1}\bar{\mathbf{x}}' \mathbf{S}_{XX}^{-1} \\ -\frac{1}{n-1}\mathbf{S}_{XX}^{-1} \bar{\mathbf{x}} & \frac{1}{n-1}\mathbf{S}_{XX}^{-1} \end{matrix}\right] \left[\begin{matrix} n\bar{y} \\ \mathbf{X}'\mathbf{y} \end{matrix}\right] \\ &= \left[\begin{matrix} n^{-1}n\bar{y} + \frac{n\bar{y}}{n-1}\bar{\mathbf{x}}' \mathbf{S}_{XX}^{-1} \bar{\mathbf{x}} - \frac{1}{n-1}\bar{\mathbf{x}}' \mathbf{S}_{XX}^{-1}\mathbf{X}'\mathbf{y}\\ -\frac{n\bar{y}}{n-1}\mathbf{S}_{XX}^{-1} \bar{\mathbf{x}} + \frac{1}{n-1}\mathbf{S}_{XX}^{-1}\mathbf{X}'\mathbf{y} \end{matrix}\right] \end{align*}\]

Then, working first with the second row-block:

\[\begin{align*} \hat{\boldsymbol{\beta}}_{-0} &= -\frac{n\bar{y}}{n-1}\mathbf{S}_{XX}^{-1} \bar{\mathbf{x}} + \frac{1}{n-1}\mathbf{S}_{XX}^{-1}\mathbf{X}'y \\ &= \frac{1}{n-1}\mathbf{S}_{XX}^{-1}\mathbf{X}'y -\frac{1}{n-1}\mathbf{S}_{XX}^{-1} \bar{\mathbf{x}}n\bar{y} \\ &= \frac{1}{n-1}\mathbf{S}_{XX}^{-1}\left(\mathbf{X}'y - n\bar{\mathbf{x}}\bar{y}\right) \end{align*}\]

Now, we note that:

\[\begin{align*} \mathbf{X}'\mathbf{y}- n\bar{\mathbf{x}}\bar{y} &= \mathbf{X}'\mathbf{y}- n\bar{\mathbf{x}}\bar{y} \\ &= \mathbf{X}'\mathbf{y}- n\left(\frac{\mathbf{X}'\mathbf{1}}{n}\right)\left(\frac{\mathbf{1}'\mathbf{y}}{n}\right) \\ &= \mathbf{X}'\mathbf{y}- \frac{1}{n}\mathbf{X}'\mathbf{1}\mathbf{1}'\mathbf{y}\\ &= \mathbf{X}' \left(\mathbf{I}- \frac{1}{n} \mathbf{1}\mathbf{1}' \right) \mathbf{y}\\ &= \mathbf{X}' \mathbf{C}\mathbf{y}\\ &= (n-1)\mathbf{S}_{Xy} \end{align*}\]

Then, we have that:

\[\hat{\boldsymbol{\beta}}_{-0} = \frac{1}{n-1}\mathbf{S}_{XX}^{-1}(n-1)\mathbf{S}_{Xy} = \mathbf{S}_{XX}^{-1}\mathbf{S}_{Xy}\] An equivalent result to that of simple linear regression, both using the covariance matrix of the independent variables and the covariance vector of the independent variables and the dependent variable.

This way of writing the coefficients shows the influence of each component:

- \(\mathbf{S}_{XX}^{-1}\): The relationship between the independent variables.

- \(\mathbf{S}_{Xy}\): The relationship between the independent variables and the dependent variables.

Also notice that, since centralizing doesn’t change the values of \(\mathbf{S}_{X_cX_c}^{-1}\) and \(\mathbf{S}_{X_cy_c}\), centralizing the independent variables or the dependent variable (or both), doesn’t change the value of the coefficients of the independent variables.

Now, we can work more easily with the intercept estimate:

\[\begin{align*} \hat{\beta}_0 &= n^{-1}n\bar{y} + \frac{n\bar{y}}{n-1}\bar{\mathbf{x}}' \mathbf{S}_{XX}^{-1} \bar{\mathbf{x}} - \frac{1}{n-1}\bar{\mathbf{x}}' \mathbf{S}_{XX}^{-1}\mathbf{X}'\mathbf{y}\\ &= \bar{y} + \frac{1}{n-1}\bar{\mathbf{x}}'\mathbf{S}_{XX}^{-1} n\bar{\mathbf{x}}\bar{y} - \frac{1}{n-1}\bar{\mathbf{x}}'\mathbf{S}_{XX}^{-1}\mathbf{X}'\mathbf{y}\\ &= \bar{y} + \frac{1}{n-1}\bar{\mathbf{x}}'\mathbf{S}_{XX}^{-1} \left(n\bar{\mathbf{x}}\bar{y} - \mathbf{X}'\mathbf{y}\right) \\ &= \bar{y} - \frac{1}{n-1}\bar{\mathbf{x}}'\mathbf{S}_{XX}^{-1} \left(\mathbf{X}'\mathbf{y}- n\bar{\mathbf{x}}\bar{y} \right) \\ &= \bar{y} - \frac{1}{n-1}\bar{\mathbf{x}}'\mathbf{S}_{XX}^{-1} (n-1)\mathbf{S}_{Xy} \\ &= \bar{y} - \bar{\mathbf{x}}'\mathbf{S}_{XX}^{-1} \mathbf{S}_{Xy} \\ &= \bar{y} - \bar{\mathbf{x}}' \hat{\boldsymbol{\beta}}_{-0} \end{align*}\]

Again, an equivalent result to that of simple linear regression. Like in simple linear regression, centering the independent variables does affect the intercept estimate, since \(\bar{\mathbf{x}}=\mathbf{0}\), we have that the coefficient after centering the independent variables is \(\bar{y}\) the mean of the dependent variable. And if we also center the dependent variable, then \(\bar{y}=0\) so the estimate of the intercept is \(0\) also. Therefore, if you are centering all variables, it is not necessary to add the column of ones in the design matrix, since the estimate of the intercept is \(0\).

6.7.3 Satandard Variables

In the same way we worked with centered variables, we can work with standard variables to define the sample correlations.

The standardization of \(\mathbf{X}\), \(\mathbf{X}_s\), is given by:

\[\begin{align*} \mathbf{X}_s &= \left[\begin{matrix} \frac{x_{11} - \bar{\mathbf{x}}_1}{S_{x_1x_1}^{1/2}} & \frac{x_{12} - \bar{\mathbf{x}}_2}{S_{x_2x_2}^{1/2}} & \dots & \frac{x_{1p} - \bar{\mathbf{x}}_p}{S_{x_px_p}^{1/2}} \\ \frac{x_{21} - \bar{\mathbf{x}}_1}{S_{x_1x_1}^{1/2}} & \frac{x_{22} - \bar{\mathbf{x}}_2}{S_{x_2x_2}^{1/2}} & \dots & \frac{x_{2p} - \bar{\mathbf{x}}_p}{S_{x_px_p}^{1/2}} \\ \vdots & \vdots & \ddots & \vdots \\ \frac{x_{n1} - \bar{\mathbf{x}}_1}{S_{x_1x_1}^{1/2}} & \frac{x_{n2} - \bar{\mathbf{x}}_2}{S_{x_2x_2}^{1/2}} & \dots & \frac{x_{np} - \bar{\mathbf{x}}_p}{S_{x_px_p}^{1/2}} \end{matrix}\right] \\ &= \left[\begin{matrix} x_{11} - \bar{\mathbf{x}}_1 & x_{12} - \bar{\mathbf{x}}_2 & \dots & x_{1p} - \bar{\mathbf{x}}_p \\ x_{21} - \bar{\mathbf{x}}_1 & x_{22} - \bar{\mathbf{x}}_2 & \dots & x_{2p} - \bar{\mathbf{x}}_p \\ \vdots & \vdots & \ddots & \vdots \\ x_{n1} - \bar{\mathbf{x}}_1 & x_{n2} - \bar{\mathbf{x}}_2 & \dots & x_{np} - \bar{\mathbf{x}}_p \end{matrix}\right] \left[\begin{matrix} \frac{1}{S_{x_1x_1}^{1/2}} & 0 & \dots & 0 \\ 0 & \frac{x_{22} - \bar{\mathbf{x}}_2}{S_{x_2x_2}^{1/2}} & \dots & 0 \\ \vdots & \vdots & \ddots & \vdots \\ 0 & 0 & \dots & \frac{x_{np} - \bar{\mathbf{x}}_p}{S_{x_px_p}^{1/2}} \end{matrix}\right] &= \mathbf{X}_c \mathbf{D}_X &= \mathbf{C}\mathbf{X}\mathbf{D}_X \end{align*}\]

where

\[ \mathbf{D}_X = \left[\begin{matrix} \frac{1}{S_{x_1x_1}^{1/2}} & 0 & \dots & 0 \\ 0 & \frac{x_{22} - \bar{\mathbf{x}}_2}{S_{x_2x_2}^{1/2}} & \dots & 0 \\ \vdots & \vdots & \ddots & \vdots \\ 0 & 0 & \dots & \frac{x_{np} - \bar{\mathbf{x}}_p}{S_{x_px_p}^{1/2}} \end{matrix}\right]\]

is the matrix that standardizes \(\mathbf{X}\). Notice that unlike \(\mathbf{C}\), that centers any matrix with the appropriate number of rows, \(\mathbf{D}_X\) only standardizes \(\mathbf{X}\).

6.7.4 Sample Correlation Matrix

We define the sample correlation matrix as:

\[ r_{XX} = \frac{\mathbf{X}_s'\mathbf{X}_s}{n-1} \] where we break a little our notation convention of using bold capital letters for matrices. Entry at row \(i\) and column \(j\) of \(r_{XX}\) is given by:

\[ \left[r_{XX}\right]_{ij} = \frac{S_{x_i x_j}}{S_{x_ix_i}^{1/2}S_{x_jx_j}^{1/2}} \]

We can also define the sample correlation between \(\mathbf{X}\) and \(\mathbf{y}\) as follows:

\[r_{Xy} = \frac{\mathbf{X}_s' \mathbf{y}_s}{n-1} \]

where \(\mathbf{y}_s\) is the standardization of \(\mathbf{y}\).

With this definitions in hand, we can see how the coefficients look like with standardized variables. Since, standardized variables are also centered, it is not necessary to include the column of ones in the design matrix, as the intercept estimate is always 0. Then the estimate of the coefficients of the independent variables is given by:

\[\hat{\boldsymbol{\beta}_s} = \left(\mathbf{X}_s' \mathbf{X}_s \right)^{-1} \mathbf{X}_s' \mathbf{y}_s = \frac{1}{n-1}r_{XX}^{-1}(n-1)r_{Xy}=r_{XX}^{-1}r_{Xy}\] Notice that the coefficients estimates do change for standardized variables, since in general \(r_{XX}\neq\mathbf{S}_{XX}\) and \(r_{Xy}\neq\mathbf{S}_{Xy}\). In the case of standardized variables the coefficient estimates depend in part from the correlation between independent variables \(r_{XX}\) and the correlations between independent and dependent variables \(r_{Xy}\).

Working with standardized variables is useful, since standardized variables are unit-less, so the estimated coefficients magnitudes are comparable.

We can see these results in practice with our GDP data:

# Read Data

dat <- read.csv("Gdp data.csv")

# Design Matrix Independent Variables

X <- as.matrix(dat[, -1])

# Dependent Variable

y <- dat$gdp

# Number of Observations

n <- nrow(X)

# Design Matrix with the column of Ones

Z <- cbind(rep(1, n), X)

# Centering

# Vector of Ones

v1 <- rep(1, n)

# Centering Matrix

C <- diag(n) - (1/n) * v1 %*% t(v1)

# Independent Variables Centered

Xc <- C %*% X

# Dependent Variable Centered

yc <- C %*% y

# Design Matrix with Independent Variables Centered

Zc <- cbind(rep(1, n), Xc)

# Checks that the Variables are actually centered

print(round(colMeans(Xc), 8))## inf une int gov exp

## 0 0 0 0 0## [1] 0## [1] 2.981131# Compute the Estimates of the Coefficients with Original Variables

b <- solve(t(Z) %*% Z, t(Z) %*% y)

# Compute the Estimates of the Coefficients with Centered Independent Variables Only

bs1 <- solve(t(Zc) %*% Zc, t(Zc) %*% y)

# Compute the Estimates of the Coefficients with All Variables Centered

bs2 <- solve(t(Zc) %*% Zc, t(Zc) %*% yc)

# Compute the Estimates of the Coefficients with All variables Centered and no column of ones

bs3 <- solve(t(Xc) %*% Xc, t(Xc) %*% yc)

# Shows the Estimated Coefficients Side-by-Side

print(round(cbind(b, bs1, bs2, c(0, bs3)), 8))## [,1] [,2] [,3] [,4]

## 1.55530096 2.98113131 0.00000000 0.00000000

## inf 0.31221813 0.31221813 0.31221813 0.31221813

## une -0.37733403 -0.37733403 -0.37733403 -0.37733403

## int 0.17782709 0.17782709 0.17782709 0.17782709

## gov -0.00848329 -0.00848329 -0.00848329 -0.00848329

## exp 0.06465692 0.06465692 0.06465692 0.06465692Here we can appreciate that the estimated coefficients for the independent variables

do not change, however the estimate for the intercept changes depending on if the

independent variables are centered or the dependent variable is centered of both. Also, notice that

this are the that we had using the lm function of R.

We can also check that computing the sample covariance matrix using our formula

results in the same quantities that using the cov function in R.

# Sample Covariance of X

SXX <- t(Xc) %*% Xc / (n-1)

# Sample Covariance between X and y

SXy <- t(Xc) %*% yc / (n-1)

# Shows the comparison in covariance matrices

print(SXX)## inf une int gov exp

## inf 4.03991957 -1.28576595 1.52551017 2.4374124 0.03447976

## une -1.28576595 0.66963355 -0.27282160 -0.5319862 0.02605596

## int 1.52551017 -0.27282160 0.83778484 0.7633037 0.04335484

## gov 2.43741235 -0.53198621 0.76330368 15.2006711 0.21732195

## exp 0.03447976 0.02605596 0.04335484 0.2173220 9.10237220## inf une int gov exp

## inf 4.03991957 -1.28576595 1.52551017 2.4374124 0.03447976

## une -1.28576595 0.66963355 -0.27282160 -0.5319862 0.02605596

## int 1.52551017 -0.27282160 0.83778484 0.7633037 0.04335484

## gov 2.43741235 -0.53198621 0.76330368 15.2006711 0.21732195

## exp 0.03447976 0.02605596 0.04335484 0.2173220 9.10237220## [,1]

## inf 1.9993285

## une -0.6964324

## int 0.7245455

## gov 0.9825766

## exp 0.5953308## [,1]

## inf 1.9993285

## une -0.6964324

## int 0.7245455

## gov 0.9825766

## exp 0.5953308Finally, we can test our new formulas for the estimates:

# Computes the estimates of the coefficients using the covariance matrices

b1 <- solve(SXX, SXy)

b0 <- mean(y) - t(colMeans(X)) %*% b1

# Shows the Estimates Side by Side

print(round(cbind(b, c(b0, b1)), 8))## [,1] [,2]

## 1.55530096 1.55530096

## inf 0.31221813 0.31221813

## une -0.37733403 -0.37733403

## int 0.17782709 0.17782709

## gov -0.00848329 -0.00848329

## exp 0.06465692 0.06465692In the same way, we can work with the sample correlations

# Standardizing matrix of X

DX <- diag(1/sqrt(diag(SXX)))

# Standardize X

Xs <- Xc %*% DX

# Shows that Xs is indeed standardize

print(round(colMeans(Xs), 8))## [1] 0 0 0 0 0## [1] 1 1 1 1 1## [1] 0## [1] 1# Sample Correlation of X

rXX <- t(Xs) %*% Xs / (n-1)

# Sample Correlation between X and y

rXy <- t(Xs) %*% ys / (n-1)

# Shows the comparison in correlation matrices

print(rXX)## [,1] [,2] [,3] [,4] [,5]

## [1,] 1.000000000 -0.78173033 0.8292061 0.31103644 0.005685918

## [2,] -0.781730327 1.00000000 -0.3642453 -0.16674407 0.010553855

## [3,] 0.829206121 -0.36424525 1.0000000 0.21389456 0.015699798

## [4,] 0.311036436 -0.16674407 0.2138946 1.00000000 0.018475446

## [5,] 0.005685918 0.01055386 0.0156998 0.01847545 1.000000000## inf une int gov exp

## inf 1.000000000 -0.78173033 0.8292061 0.31103644 0.005685918

## une -0.781730327 1.00000000 -0.3642453 -0.16674407 0.010553855

## int 0.829206121 -0.36424525 1.0000000 0.21389456 0.015699798

## gov 0.311036436 -0.16674407 0.2138946 1.00000000 0.018475446

## exp 0.005685918 0.01055386 0.0156998 0.01847545 1.000000000## [,1]

## [1,] 0.8751311

## [2,] -0.7487479

## [3,] 0.6964256

## [4,] 0.2217228

## [5,] 0.1736027## [,1]

## inf 0.8751311

## une -0.7487479

## int 0.6964256

## gov 0.2217228

## exp 0.1736027and can test that:

\[\hat{\boldsymbol{\beta}_s} = r_{XX}^{-1}r_{Xy}\]

# Computes the estimates of the coefficients using the covariance matrices

bs1 <- solve(t(Xs) %*% Xs, t(Xs) %*% ys)

bs2 <- solve(rXX, rXy)

# Shows the Estimates Side by Side

print(round(cbind(bs1, bs2), 8))## [,1] [,2]

## [1,] 0.55210259 0.55210259

## [2,] -0.27165637 -0.27165637

## [3,] 0.14319884 0.14319884

## [4,] -0.02909852 -0.02909852

## [5,] 0.17161988 0.17161988We can also contrast the effects of the standarization on the coefficients

# Computes the estimates of the coefficients using the covariance matrices

bs1 <- lm(y ~ X)$coefficients

bs2 <- lm(ys ~ Xs)$coefficients

# Shows the Estimates Side by Side

print(round(cbind(bs1, bs2), 8))## bs1 bs2

## (Intercept) 1.55530096 0.00000000

## Xinf 0.31221813 0.55210259

## Xune -0.37733403 -0.27165637

## Xint 0.17782709 0.14319884

## Xgov -0.00848329 -0.02909852

## Xexp 0.06465692 0.17161988First, we can observe the 0 intercept estimate on the standardize values, so it

is not necessary to estimate it, we could have done so by using lm(ys ~ Xs - 1)

instead of lm(ys ~ Xs). Next we observe, the change in magnitudes for the

estimated coefficients of the independent variables.

6.8 Variable Cross-Effects

For this sub-section we will work with standardized values so there is no need to estimate the intercept. Since all variables are standardized, we will not use the \(\mathbf{X}_s\) notation, but instead only \(\mathbf{X}\), to make notation less confusing.

The same goes with \(\hat{\boldsymbol{\beta}}_s\), it will be only \(\hat{\boldsymbol{\beta}}\).

The idea is to analyze the estimated coefficients when you divide the independent variables in to groups \(1\) and \(2\). So we can divide the design matrix in two:

\[\mathbf{X}= [\mathbf{X}_1 \mathbf{X}_2]\] Then, we can compute the coefficient estimates:

\[\hat{\boldsymbol{\beta}} = \left[\begin{matrix} \hat{\boldsymbol{\beta}}_1 \\ \hat{\boldsymbol{\beta}}_2 \end{matrix}\right] = \left([\mathbf{X}_1 \mathbf{X}_2]'[\mathbf{X}_1 \mathbf{X}_2]\right)^{-1}[\mathbf{X}_1 \mathbf{X}_2]' \mathbf{y}\]

So, we can work with these computations in the same way we did before:

\[\begin{align*} [\mathbf{X}_1 \mathbf{X}_2]'[\mathbf{X}_1 \mathbf{X}_2] &= \left[\begin{matrix} \mathbf{X}_1' \\ \mathbf{X}_2' \end{matrix}\right] [\mathbf{X}_1 \mathbf{X}_2] \\ &= \left[\begin{matrix} \mathbf{X}_1'\mathbf{X}_1 & \mathbf{X}_1'\mathbf{X}_2 \\ \mathbf{X}_2'\mathbf{X}_1 & \mathbf{X}_2'\mathbf{X}_2 \end{matrix}\right] \\ &= (n-1) \left[\begin{matrix} \frac{\mathbf{X}_1'\mathbf{X}_1}{n-1} & \frac{\mathbf{X}_1'\mathbf{X}_2}{n-1} \\ \frac{\mathbf{X}_2'\mathbf{X}_1}{n-1} & \frac{\mathbf{X}_2'\mathbf{X}_2}{n-1} \end{matrix}\right] \\ &= (n-1) \left[\begin{matrix} r_{X_1X_1} & r_{X_1X_2} \\ r_{X_2X_1} & r_{X_2X_2} \end{matrix}\right] \end{align*}\]

In the same way, we have that:

\[\begin{align*} [\mathbf{X}_1 \mathbf{X}_2]'\mathbf{y} &= \left[\begin{matrix} \mathbf{X}_1' \\ \mathbf{X}_2' \end{matrix}\right] \mathbf{y}\\ &= \left[\begin{matrix} \mathbf{X}_1'\mathbf{y}\\ \mathbf{X}_2'\mathbf{y} \end{matrix}\right] \\ &= (n-1) \left[\begin{matrix} \frac{\mathbf{X}_1'\mathbf{y}}{n-1} \\ \frac{\mathbf{X}_2'\mathbf{y}}{n-1} \end{matrix}\right] \\ &= (n-1) \left[\begin{matrix} r_{X_1y} \\ r_{X_2y} \end{matrix}\right] \end{align*}\]

Then we have that:

\[ \hat{\boldsymbol{\beta}} = \left[\begin{matrix} \hat{\boldsymbol{\beta}}_1 \\ \hat{\boldsymbol{\beta}}_2 \end{matrix}\right] = \left((n-1) \left[\begin{matrix} r_{X_1X_1} & r_{X_1X_2} \\ r_{X_2X_1} & r_{X_2X_2} \end{matrix}\right]\right)^{-1} (n-1) \left[\begin{matrix} r_{Xy,1} \\ r_{Xy,2} \end{matrix}\right] = \left[\begin{matrix} r_{X_1X_1} & r_{X_1X_2} \\ r_{X_2X_1} & r_{X_2X_2} \end{matrix}\right]^{-1} \left[\begin{matrix} r_{X_1y} \\ r_{X_2y} \end{matrix}\right] \]

Now we can compute the inverse of the 2 by 2 block matrix as before with, but first we define:

\[r_{X_1|X_2} = r_{X_1X_1} - r_{X_1X_2}r_{X_2X_2}^{-1}r_{X_2X_1}\] this is also, the Schur component. This can also be seen as the sample correlation matrix of \(X_1\) after accounting by the relationships with \(X_2\).

\[ \left[\begin{matrix} r_{XX,11} & r_{XX,12} \\ r_{XX,12} & r_{XX,22} \end{matrix}\right]^{-1} = \left[\begin{matrix} r_{X_1|X_2}^{-1} & -r_{X_1|X_2}^{-1}r_{X_1X_2}r_{X_2X_2}^{-1} \\ -r_{X_2X_2}^{-1}r_{X_2X_1}r_{X_1|X_2}^{-1} & r_{X_2X_2}^{-1}r_{X_2X_1}r_{X_1|X_2}^{-1}r_{X_1X_2}r_{X_2X_2}^{-1} \end{matrix}\right] \] Then, we have that:

\[\begin{align*} \hat{\boldsymbol{\beta}} &= \left[\begin{matrix} \hat{\boldsymbol{\beta}}_1 \\ \hat{\boldsymbol{\beta}}_2 \end{matrix}\right] \\ &= \left[\begin{matrix} r_{X_1|X_2}^{-1} & -r_{X_1|X_2}^{-1}r_{X_1X_2}r_{X_2X_2}^{-1} \\ -r_{X_2X_2}^{-1}r_{X_2X_1}r_{X_1|X_2}^{-1} & r_{X_2X_2}^{-1}r_{X_2X_1}r_{X_1|X_2}^{-1}r_{X_1X_2}r_{X_2X_2}^{-1} \end{matrix}\right] \left[\begin{matrix} r_{X_1y} \\ r_{X_2y} \end{matrix}\right] \\ &= \left[\begin{matrix} r_{X_1|X_2}^{-1}r_{X_1y} -r_{X_1|X_2}^{-1}r_{X_1X_2}r_{X_2X_2}^{-1}r_{X_2y} \\ -r_{X_2X_2}^{-1}r_{X_2X_1}r_{X_1|X_2}^{-1}r_{X_1y} + r_{X_2X_2}^{-1}r_{X_2X_1}r_{X_1|X_2}^{-1}r_{X_1X_2}r_{X_2X_2}^{-1}r_{X_2y} \end{matrix}\right] \end{align*}\]

Since the variables in the groupings 1 and 2 can be switched and have no special characteristics, we only need to analyze the structure of \(\hat{\boldsymbol{\beta}}_1\) in relation to the variables of group 2, the results would be analogous for \(\hat{\boldsymbol{\beta}}_1\).

Then we have that:

\[ \hat{\boldsymbol{\beta}}_1 = r_{X_1|X_2}^{-1}r_{X_1y} -r_{X_1|X_2}^{-1}r_{X_1X_2}r_{X_2X_2}^{-1}r_{X_2y} = r_{X_1|X_2}^{-1}\left(r_{X_1y} -r_{X_1X_2}r_{X_2X_2}^{-1}r_{X_2y}\right) \] Now, suppose that we want to fit the following linear models:

\[\mathbf{y}= \mathbf{X}_1 \boldsymbol{\beta}_1 + \mathbf{e}\quad \text{and} \quad \mathbf{y}= \mathbf{X}_2 \boldsymbol{\beta}_2 + \mathbf{e}\] that is a linear model of \(\mathbf{y}\) using only the variables in group 1 for one model and only variables from the group 2 in the second model. Then, the coefficient estimates will be:

\[\tilde{\boldsymbol{\beta}}_1 = r_{X_1X_1}^{-1}r_{X_1y} \quad \text{and} \quad \tilde{\boldsymbol{\beta}}_2 = r_{X_2X_2}^{-1}r_{X_2y}\] Note that, in general, this estimates will be different to the estimates using all the variables, that is:

\[\tilde{\boldsymbol{\beta}}_1 \neq \hat{\boldsymbol{\beta}}_1 \quad \text{and} \quad \tilde{\boldsymbol{\beta}}_2 \neq \hat{\boldsymbol{\beta}}_2\] Then, we can re-write, our coefficient estimate for \(\boldsymbol{\beta}_1\) as follows:

\[ \hat{\boldsymbol{\beta}}_1 = r_{X_1|X_2}^{-1}\left(r_{X_1y} -r_{X_1X_2}\tilde{\boldsymbol{\beta}}_2\right) \] Now, if \(r_{X_1X_2} = \mathbf{0}\), that is the variables in group 1 and group 2 are uncorrelated, then

\[r_{X_1|X_2} = r_{X_1X_1} - r_{X_1X_2}r_{X_2X_2}^{-1}r_{X_2X_1} = r_{X_1X_1}\] so: \[\hat{\boldsymbol{\beta}}_1 = r_{X_1|X_2}^{-1}\left(r_{X_1y} -r_{X_1X_2}\tilde{\boldsymbol{\beta}}_2\right) = r_{X_1X_1}^{-1}r_{X_1y} = \tilde{\boldsymbol{\beta}}_1\] So, when the variables in 1 group are uncorrelated with the other the coefficient estimates are the same for the full and partial model.

We can also deduce that even when the sample correlation between \(X_1\) and \(y\) is \(\mathbf{0}\), that is \(r_{X_1y} = \mathbf{0}\), the estimated coefficients will not be \(\mathbf{0}\) in general. In fact, we have that:

\[ \hat{\boldsymbol{\beta}}_1 = -r_{X_1|X_2}^{-1}r_{X_1X_2}\tilde{\boldsymbol{\beta}}_2 \]

6.8.1 Single Variable Cross-Effects

In the special case where group 1 consists of only 1 variable, we have that:

\(\hat{\beta}_1, \quad r_{X_1X_1} = r_{x_1x_1}=1, \quad r_{X_1|X_2}=r_{x_1|X_2}, \quad r_{X_1y}=r_{x_1y}=\tilde{\beta}_1\)

are scalars, while

\[r_{X_1X_2} = r_{x_1X_2}=r_{X_2X_1}' = r_{X_2x_1}', \quad r_{X_2y}, \quad \tilde{\boldsymbol{\beta}}_2\] are vectors of size \(p-1\).

Now, consider the following linear model:

\[\mathbf{x}_1 = \mathbf{X}_2 \boldsymbol{\alpha}_2 + \mathbf{e}\]

that is, fitting the single variable in group 1, as the dependent variable, and the variables in group 2, as the independent variables. Then we have that the estimated coefficients are:

\[ \hat{\boldsymbol{\alpha}}_2 = r_{X_2X_2}^{-1}r_{X_2x_1}\] then, we notice the following

\[r_{x_1|X_2} = r_{X_1X_1} - r_{X_1X_2}r_{X_2X_2}^{-1}r_{X_2X_1} = r_{x_1X_1} - r_{x_1X_2}r_{X_2X_2}^{-1}r_{X_2x_1} = 1 - r_{x_1X_2}\hat{\boldsymbol{\alpha}}_2 = 1 - r_{x_1X_2}r_{X_2X_2}^{-1}r_{X_2X_2}\hat{\boldsymbol{\alpha}}_2 = 1 - \hat{\boldsymbol{\alpha}}_2'r_{X_2X_2}\hat{\boldsymbol{\alpha}}_2 = 1 - R^2_1 \]

where, \(R^2_1\) is the multiple coefficient of determination for model:

\[\mathbf{x}_1 = \mathbf{X}_2 \boldsymbol{\alpha}_2 + \mathbf{e}\]

that is, how much of \(\mathbf{x}_1\) is explained by \(\mathbf{X}_2\).

Then, we have that:

\[\hat{\beta}_1 = r_{1_1|X_2}^{-1}\left(r_{x_1y} -r_{x_1X_2}\tilde{\boldsymbol{\beta}}_2\right) = \frac{1}{1-R^2_1} \left(\tilde{\beta}_1 -r_{x_1X_2}\tilde{\boldsymbol{\beta}}_2\right)\] We name \(\frac{1}{1 - R^2_1}\) as:

\[VIF_1 = \frac{1}{1 - R^2_1} \] the bigger, the more distorted is the value of \(\hat{\beta}_1\). This number increases as \(R^2_1\) in creases.

If \(R^2_1 = 0\), that is \(\mathbf{X}_2\) explains nothing of \(\mathbf{x}_1\), then

\[ VIF_1 = 1 \] that represents no distortion. If \(R^2_1 \to 1\), then:

\[ VIF_1 \to 1 \] which represents infinite distortion.

The name \(VIF\) stands for variance inflation factor. We will see that later, how it relates to the variance of the estimate \(\hat{\beta}_1\).

Of course, variable 1, didn’t have any particular property, so we can generalize this to any variable \(k\).

On the other hand, we also have an effect \(r_{x_1X_2}\tilde{\boldsymbol{\beta}}_2\) on the coefficient

6.8.1.1 Single Variable Cross-effects example

We can see the effects the other variables have in changing the coefficients in our GDP data set, by computing \(R^2_k\) for each variable.

# Re-names Standardized Variables

y <- ys

X <- Xs

# Coefficients for the Full Model

b <- lm(y ~ X -1)$coefficients

# Individual Coefficients

# Number of Variables

P <- ncol(X)

# Vector to Save Individual Coefficients

bi <- numeric(length = P)

for(k in 1:P){

bi[k] <- lm(y ~ X[, k] - 1)$coefficients

}

# Coefficients without variable k

bt <- matrix(data = NA, nrow = P-1, ncol = P)

for(k in 1:P){

bt[, k] <- lm(y ~ X[, -k] - 1)$coefficients

}

# Coefficient of Determination of X_k ~ X_{-k} models and coefficients

R2k <- numeric(length = P)

for(k in 1:P){

outReg <- lm(X[, k] ~ X[, -k] - 1)

R2k[k] <- summary(outReg)$r.squared

}

# Cross product of correlation and coefficients

rbt <- numeric(length = P)

rXX <- cor(X)

for(k in 1:P){

rbt[k] <- rXX[k, -k] %*% bt[, k]

}

# Formats and Show Info Table

tab <- cbind(b, bi, R2k, 1/(1-R2k), rbt)

colnames(tab) <- c("b_full", "b_ind", "R2k", "VIF", "rb_ind")

rownames(tab) <- colnames(dat)[2:6]

knitr::kable(tab)| b_full | b_ind | R2k | VIF | rb_ind | |

|---|---|---|---|---|---|

| inf | 0.5521026 | 0.8751311 | 0.9604527 | 25.286192 | 0.8532969 |

| une | -0.2716564 | -0.7487479 | 0.8843302 | 8.645299 | -0.7173255 |

| int | 0.1431988 | 0.6964256 | 0.9061532 | 10.655663 | 0.6829869 |

| gov | -0.0290985 | 0.2217228 | 0.2067576 | 1.260649 | 0.2448050 |

| exp | 0.1716199 | 0.1736027 | 0.0008505 | 1.000851 | 0.0021287 |

6.9 Outliers and Leverage

It is harder to identify outliers visually in multiple linear regression, specially if the number of variables is big. The effect of an observation \(i\) on the linear regression fit will depend on 2 things:

- The size of the residual for observation \(i\), that is \(\hat{e}_i^2\).

- How “close” is observation \(i\) to other observations.

Note: For this section, we are going to use \(X_i\in\mathbb{R}^{1 \times p}\) as the \(i-th\) row of the design matrix. That is the \(i\)-th observation of the independent varaibles.

6.9.1 Leverage

In multiple linear regression, leverage refers to the influence that a particular data point has on the estimation of the regression model. Specifically, it measures how far an observation’s values for the independent variables deviate from the mean of those variables. Leverage identifies data points that could potentially have a significant effect on the regression line, particularly those that are outliers in terms of the input variables.

Leverage values are calculated from the hat matrix \(\mathbf{H}\), which is derived from the design matrix \(\mathbf{X}\) used in the regression. The diagonal elements of the hat matrix, \(h_{ii}\), represent the leverage of each data point. These values range from 0 to 1, where:

- A leverage value close to 0 indicates that the point is not influential in determining the regression line.

- A leverage value closer to 1 suggests that the point has a higher influence on the fitted model.

High-leverage points are those whose independent variable values are far from the average, and they may disproportionately affect the slope and intercept of the regression line. These points can distort the regression model, leading to biased estimates if not handled properly.

A high-leverage point may not necessarily be an outlier in the response variable (dependent variable), but it could have a significant impact on the overall model fit, making leverage a critical diagnostic in regression analysis.

6.9.1.1 Properties of Leverages

Lets analyze the structure of the hat matrix.

First, let us see that \(\mathbf{H}\) is symmetric semi-positive definite. Pick \(z \in \mathbb{R}^n\). Recall, that \(\mathbf{X}' \mathbf{X}\) is positive definite, then \[(\mathbf{X}'\mathbf{X})^{-1}\] is positive definite. Then

\[\begin{align*} z'Hz &= \mathbf{z}'\mathbf{X}(\mathbf{X}'\mathbf{X})^{-1}\mathbf{X}'z \\ &= (\mathbf{X}'\mathbf{z})'(\mathbf{X}'\mathbf{X})^{-1}(\mathbf{X}'\mathbf{z}) \\ &= \mathbf{w}' (\mathbf{X}'\mathbf{X})^{-1} \mathbf{w}& \mathbf{w}= \mathbf{X}'\mathbf{z}\\ &\geq 0 \end{align*}\]

Therefore, \(\mathbf{H}\) is semi-positive definite. This implies that all the eigenvalues of \(\mathbf{H}\) are non-negative, that is positive or \(0\).

Next, let us see that the diagonal elements are between 0 and 1.

To see this, consider leverage \(i\) (\(h_{ii}\)), and the basis vectors \(v_j \in \mathbb{R}^n\) such that are full of zeros except for entry \(j\). Then:

\[h_{ij} = v_i '\mathbf{H}v_j\] in particular, leverage \(i\) is given by:

\[h_{ii} = v_i '\mathbf{H}v_i\] Now, consider \(\mathbf{H}v_i\) and notice that:

\[\begin{align*} ||v_i - \mathbf{H}v_i||_2^2 &= (v_i - \mathbf{H}v_i)'(v_i - \mathbf{H}v_i) \\ &= v_i'v_i - v_i'\mathbf{H}v_i - v_i'\mathbf{H}v_i + v_i' \mathbf{H}\mathbf{H}v_i \\ &= v_i'v_i - v_i'\mathbf{H}\mathbf{H}v_i - v_i'\mathbf{H}\mathbf{H}v_i + v_i' \mathbf{H}\mathbf{H}v_i \\ &= v_i'v_i - v_i'\mathbf{H}\mathbf{H}v_i \\ &= ||v_i||_2^2 - ||\mathbf{H}v_i||_2^2 \\ &= 1 - ||\mathbf{H}v_i||_2^2 \end{align*}\]

Then

\[\begin{align*} ||v_i - \mathbf{H}v_i||_2^2 = 1 - ||\mathbf{H}v_i||_2^2 & \implies ||v_i - \mathbf{H}v_i||_2^2 + ||\mathbf{H}v_i||_2^2 = 1 \\ & \implies ||\mathbf{H}v_i||_2^2 \leq 1 \\ & \implies v_i' \mathbf{H}\mathbf{H}v_i \leq 1 \\ & \implies v_i' \mathbf{H}v_i \leq 1 \\ & \implies h_{ii} \leq 1 \\ \end{align*}\]

Since \(h_{ii}=||\mathbf{H}v_i||_2^2\) is a norm then \(h_{ii} \geq 0\), then:

\[ 0 \leq h_{ii} \leq 1 \] So, leverages are bounded.

Furthermore, we have that:

\[ \sum_{i=1}^p h_{ii} = p \]

To see this, we will need the following properties:

- \(\text{rank}(\mathbf{H}) = p.\)

- All the eigenvalues of \(\mathbf{H}\) are either 0 or 1.

As usual, we assume that \(\text{rank}(\mathbf{X}) = p\) and \(n>p\), that is there are more observations than independent variables. Then

\[\begin{align*} \text{rank}(\mathbf{X}) = p &\implies \text{rank}(\mathbf{X}'\mathbf{X}) = p \\ &\implies \text{rank}\left((\mathbf{X}'\mathbf{X})^{-1}\right) = p \\ &\implies \text{rank}\left(\mathbf{X}(\mathbf{X}'\mathbf{X})^{-1}\mathbf{X}'\right) = p \\ &\implies \text{rank}\left(\mathbf{H}\right) = p \\ \end{align*}\]

Now, let \(\lambda\) be an eigenvalue of \(\mathbf{H}\), with respective \(\mathbf{v}\) as eigenvector. Then:

\[\begin{align*} \mathbf{H}\mathbf{v}= \lambda \mathbf{v}\\ &\implies \mathbf{H}\mathbf{H}\mathbf{v}= \mathbf{H}\lambda \mathbf{v}= \lambda \mathbf{H}\mathbf{v}\\ &\implies \mathbf{H}\mathbf{v}= \lambda \lambda \mathbf{v}= \lambda^2 \mathbf{v}\\ &\implies \lambda = 1 \land \lambda = 0 \end{align*}\]

Now since, \(\mathbf{H}\) is of rank \(p\), then it must have \(p\) non-zero eigenvalues. And, since all non-zero eigenvalues are 1, then we have that:

\(\sum_{i=1}^n \lambda_i = p\)

that is the sum of the eigenvalues is \(p\). We also know that for any square matrix, the sum of the eigenvalues is equal to the trace of the matrix. Then:

\[ \text{trace}(\mathbf{H}) = p \implies \sum_{i=1}^n h_{ii} = p\] This is telling us important information about the leverages. You can compute a proportional leverage as:

\[ \frac{h_{ii}}{p}\] the proportion of the leverage \(i\) out of “all” the leverage. Or in terms of “observations”, you can compute:

\[\frac{n h_{ii}}{p}\] if this number is several times bigger than \(1\), it will be an observation with considerable leverage.

Another way to characterize the leverages can be found as follows:

Recall that the hat matrix is given by:

\[\mathbf{H}= \mathbf{X}(\mathbf{X}'\mathbf{X})^{-1}\mathbf{X}' \] and we can express the design matrix as follows:

\[ \mathbf{X}= \left[\begin{matrix} X_1 \\ X_2 \\ \vdots \\ X_n \end{matrix}\right] \]

and

\[ \mathbf{X}' = [X_1' X_2' \ldots X_n'] \]

Then, the hat matrix is given by:

\[\begin{align*} \mathbf{H} &= \mathbf{X}(\mathbf{X}'\mathbf{X})^{-1}\mathbf{X}' \\ &= \mathbf{X}(\mathbf{X}'\mathbf{X})^{-1} [X_1' X_2' \ldots X_n'] \\ &= \mathbf{X}[(\mathbf{X}'\mathbf{X})^{-1}X_1' (\mathbf{X}'\mathbf{X})^{-1}X_2' \ldots (\mathbf{X}'\mathbf{X})^{-1}X_n'] \\ &= \left[\begin{matrix} X_1 \\ X_2 \\ \vdots \\ X_n \end{matrix}\right] [(\mathbf{X}'\mathbf{X})^{-1}X_1' (\mathbf{X}'\mathbf{X})^{-1}X_2' \ldots (\mathbf{X}'\mathbf{X})^{-1}X_n'] \\ &= \left[\begin{matrix} X_1 (\mathbf{X}'\mathbf{X})^{-1}X_1' & X_1 (\mathbf{X}'\mathbf{X})^{-1}X_2' & \ldots & X_1 (\mathbf{X}'\mathbf{X})^{-1}X_n' \\ X_2 (\mathbf{X}'\mathbf{X})^{-1}X_1' & X_2 (\mathbf{X}'\mathbf{X})^{-1}X_2' & \ldots & X_2 (\mathbf{X}'\mathbf{X})^{-1}X_n' \\ \vdots & \vdots & \vdots \\ X_n (\mathbf{X}'\mathbf{X})^{-1}X_1' & X_n (\mathbf{X}'\mathbf{X})^{-1}X_2' & \ldots & X_n (\mathbf{X}'\mathbf{X})^{-1}X_n' \\ \end{matrix}\right] \end{align*}\]

we are going to use this expression latter, but we can also notice that:

\[h_{ij} = X_i (\mathbf{X}'\mathbf{X})^{-1}X_j'\] So we can characterize the leverages as:

\[h_{ij} = X_i (\mathbf{X}'\mathbf{X})^{-1}X_j'\]

6.9.2 Influential Observations

Identifying outliers in multiple regression is hard. One way to measure the influence of an observation is to see how different are the predicted values if an observation is removed. We will call:

- \(\mathbf{X}_{(i)}\) the design matrix, when the \(i\)-th observation is removed.

- \(\mathbf{y}_{(i)}\) the dependent variables without the observation \(i\).

- \(\hat{\mathbf{y}}_{(i)}\) the predicted values when the \(i\)-th observation is removed.

- \(\mathbf{H}_{(i)}\) the hat matrix when the \(i\)-th observation is removed.

Then a measure of influence can be:

\[||\mathbf{y}- \hat{\mathbf{y}}_{(i)}||^2_2 = (\mathbf{y}- \hat{\mathbf{y}}_{(i)})'(\mathbf{y}- \hat{\mathbf{y}}_{(i)}) = \sum_{j=1}^n (\mathbf{y}_j - \hat{\mathbf{y}}_{(i),j})^2\] Notice that:

\[\hat{\mathbf{y}} = \mathbf{H}\mathbf{y}\] and, similarly

\[\hat{\mathbf{y}}_{(i)} = \mathbf{H}_{(i)} \mathbf{y}_{(i)}\]

Now, let us compute:

\[\begin{align*} \hat{\mathbf{y}} &= \mathbf{H}\mathbf{y}\\ &= \left[\begin{matrix} X_1 (\mathbf{X}'\mathbf{X})^{-1}X_1' & X_1 (\mathbf{X}'\mathbf{X})^{-1}X_2' & \ldots & X_1 (\mathbf{X}'\mathbf{X})^{-1}X_n' \\ X_2 (\mathbf{X}'\mathbf{X})^{-1}X_1' & X_2 (\mathbf{X}'\mathbf{X})^{-1}X_2' & \ldots & X_2 (\mathbf{X}'\mathbf{X})^{-1}X_n' \\ \vdots & \vdots & \vdots \\ X_n (\mathbf{X}'\mathbf{X})^{-1}X_1' & X_n (\mathbf{X}'\mathbf{X})^{-1}X_2' & \ldots & X_n (\mathbf{X}'\mathbf{X})^{-1}X_n' \\ \end{matrix}\right] \left[\begin{matrix} y_1 \\ y_2 \\ \vdots \\ y_n \end{matrix}\right] \\ &= \left[\begin{matrix} \sum_{k=1}^n X_1 (\mathbf{X}'\mathbf{X})^{-1}X_k'y_k \\ \sum_{k=1}^n X_2 (\mathbf{X}'\mathbf{X})^{-1}X_k'y_k \\ \vdots \\ \sum_{k=1}^n X_n (\mathbf{X}'\mathbf{X})^{-1}X_k'y_k \end{matrix}\right] \end{align*}\]

\[ \]

Then

\[\hat{y}_j = \sum_{k=1}^n X_j (\mathbf{X}'\mathbf{X})^{-1}X_k'y_k = X_j (\mathbf{X}'\mathbf{X})^{-1} \sum_{k=1}^n X_k'y_k\] in a similar way, observation :

\[\hat{y}_{(i)j} = \sum_{k=1}^n X_j (\mathbf{X}_{(i)}'\mathbf{X}_{(i)})^{-1}X_k'y_k = X_j (\mathbf{X}_{(i)}'\mathbf{X}_{(i)})^{-1} \sum_{k=1}^n X_k'y_k\] Notice that it is not necessary to use the subscript \((i)\) when we are dealing with single observations.

Now, we will relate \((\mathbf{X}'\mathbf{X})^{-1}\) to \((\mathbf{X}_{(i)}'\mathbf{X}_{(i)})^{-1}\) using the Sherman–Morrison formula. First notice that:

\[\mathbf{X}' \mathbf{X}= \mathbf{X}_{(i)}'\mathbf{X}_{(i)} + X_i'X_i\]

then

\[\mathbf{X}_{(i)}'\mathbf{X}_{(i)} = \mathbf{X}' \mathbf{X}- X_i'X_i\]

Now we apply the Sherman–Morrison formula.

\[\begin{align*} \left(\mathbf{X}_{(i)}'\mathbf{X}_{(i)}\right)^{-1} = \left(\mathbf{X}' \mathbf{X}- X_i'X_i\right)^{-1} &= \left(\mathbf{X}' \mathbf{X}+ (-X_i)'X_i\right)^{-1} \\ &= \left(\mathbf{X}' \mathbf{X}\right)^{-1} - \frac{\left(\mathbf{X}' \mathbf{X}\right)^{-1}(-X_i)'X_i\left(\mathbf{X}' \mathbf{X}\right)^{-1}}{1 + (-X_i)'\left(\mathbf{X}' \mathbf{X}\right)^{-1}X_i} \\ &= \left(\mathbf{X}' \mathbf{X}\right)^{-1} + \frac{\left(\mathbf{X}' \mathbf{X}\right)^{-1}X_i'X_i\left(\mathbf{X}' \mathbf{X}\right)^{-1}}{1 - X_i'\left(\mathbf{X}' \mathbf{X}\right)^{-1}X_i} \\ &= \left(\mathbf{X}' \mathbf{X}\right)^{-1} + \frac{\left(\mathbf{X}' \mathbf{X}\right)^{-1}X_i'X_i\left(\mathbf{X}' \mathbf{X}\right)^{-1}}{1 - h_{ii}} \end{align*}\]

Then,

\[\hat{y}_{(i)j} = X_j \left(\mathbf{X}_{(i)}'\mathbf{X}_{(i)}\right)^{-1} \sum_{k \neq i}X_k'y_k = X_j\left(\mathbf{X}' \mathbf{X}\right)^{-1}\sum_{k \neq i}X_k'y_k + \frac{X_j\left(\mathbf{X}' \mathbf{X}\right)^{-1}X_i'X_i\left(\mathbf{X}' \mathbf{X}\right)^{-1}\sum_{k \neq i}X_k'y_k}{1 - h_{ii}}\] Now

\[\begin{align*} X_j\left(\mathbf{X}' \mathbf{X}\right)^{-1}\sum_{k \neq i}X_k'y_k &= X_j\left(\mathbf{X}' \mathbf{X}\right)^{-1}\left(\sum_{k \neq i}X_k'y_k + X_i'y_i - X_i'y_i\right) \\ &= X_j\left(\mathbf{X}' \mathbf{X}\right)^{-1}\left(\sum_{k = 1}^nX_k'y_k - X_i'y_i\right) \\ &= X_j\left(\mathbf{X}' \mathbf{X}\right)^{-1}\sum_{k = 1}^nX_k'y_k - X_j\left(\mathbf{X}' \mathbf{X}\right)^{-1}X_i'y_i \\ &= \hat{y}_j - h_{ij}y_i \end{align*}\]

and

\[\begin{align*} X_j\left(\mathbf{X}' \mathbf{X}\right)^{-1}X_i'X_i\left(\mathbf{X}' \mathbf{X}\right)^{-1}\sum_{k \neq i}X_k'y_k &= h_{ij}X_i\left(\mathbf{X}' \mathbf{X}\right)^{-1}\sum_{k \neq i}X_k'y_k \\ &= h_{ij}\sum_{k \neq i}X_i\left(\mathbf{X}' \mathbf{X}\right)^{-1}X_k'y_k \\ &= h_{ij}\sum_{k \neq i}h_{ik}y_k \end{align*}\]

Then

\[\begin{align*} \hat{y}_{(i)j} = \hat{y}_j - h_{ij}y_i + \frac{h_{ij}\sum_{k \neq i}h_{ik}y_k}{1 - h_{ii}} &= \hat{y}_j - h_{ij}\left(y_i - \frac{\sum_{k \neq i}h_{ik}y_k}{1 - h_{ii}} \right) \\ &= \hat{y}_j - h_{ij}\left(\frac{y_i - y_ih_{ii}}{1 - h_{ii}} - \frac{\sum_{k \neq i}h_{ik}y_k}{1 - h_{ii}} \right) \\ &= \hat{y}_j - h_{ij}\left(\frac{y_i - y_ih_{ii} - \sum_{k \neq i}h_{ik}y_k}{1 - h_{ii}} \right) \\ &= \hat{y}_j - h_{ij}\left(\frac{y_i - \sum_{k=1}^n h_{ik}y_k}{1 - h_{ii}} \right) \\ &= \hat{y}_j - h_{ij}\left(\frac{y_i - \hat{y}_i}{1 - h_{ii}} \right) \\ &= \hat{y}_j - h_{ij}\left(\frac{\hat{e}_i}{1 - h_{ii}} \right) \end{align*}\]

Then

\[\begin{align*} \hat{y}_{(i)j} - \hat{y}_j = - h_{ij}\left(\frac{\hat{e}_i}{1 - h_{ii}} \right) &\implies \left(\hat{y}_{(i)j} - \hat{y}_j \right)^2= \left(h_{ij}\left(\frac{\hat{e}_i}{1 - h_{ii}} \right) \right)^2 = \frac{\hat{e}_i^2}{(1 - h_{ii})^2}h_{ij}^2 \\ &\implies \left(\hat{\mathbf{y}}_{(i)} - \hat{\mathbf{y}} \right)'\left(\hat{\mathbf{y}}_{(i)} - \hat{\mathbf{y}} \right) = \sum_{j=1}^n \frac{\hat{e}_i^2}{(1 - h_{ii})^2}h_{ij}^2 \\ &\implies ||\hat{\mathbf{y}}_{(i)} - \hat{\mathbf{y}}||_2^2 = \frac{\hat{e}_i^2}{(1 - h_{ii})^2} \sum_{j=1}^n h_{ij}^2 \end{align*}\]

Now for any symmetric and idempotent matrix \(\mathbf{M}\in \mathbb{R}^{n \times n}\) we have that:

\[m_{ii} = \sum_{j = 1}^n m_{ij}^2\] Then

\[||\hat{\mathbf{y}}_{(i)} - \hat{\mathbf{y}}||_2^2 = \frac{\hat{e}_i^2}{(1 - h_{ii})^2} h_{ii}^2 = \frac{h_{ii}}{(1 - h_{ii})^2}\hat{e}_i^2 \] That is the change in the predictions is the result of a function of the leverages and a function of the error of observation \(i\).

We can see this with our GDP dataset. We generate new observations, in which

# Reads Data

dat <- read.csv(file = "Gdp data.csv")

# Extracts the Data

y <- as.numeric(dat[, 1])

X <- as.matrix(dat[, -1])

n <- nrow(X)

X <- cbind(rep(1, n), X)

# Obtains the Estimates

b <- solve(t(X) %*% X, t(X) %*% y)

# Predicted Values

yh <- X %*% b

# Errors

eh <- abs(y - yh)

# Obtains the Minimum, Median and Maximum Errors

err <- quantile(eh, probs = c(0, 0.5, 1))

# Generates New Observations

# An observation at one extreme of the Observed Independent Variables

X1 <- apply(X = X, MARGIN = 2, FUN = max)

# An observation at the center of the Observed Independent Variables

X2 <- apply(X = X, MARGIN = 2, FUN = mean)

# Dependent Variables with different Error levels

y1 <- c(t(X1) %*% b) + c(0, err, err[3] * 2)

y2 <- c(t(X2) %*% b) + c(0, err, err[3] * 2)

# Outlier Level

m <- length(y1)

# Predictions without the Observations

yhi <- yh

bi <- b

yi <- y

Xi <- X

# Table with Changes

tab <- matrix(data = NA, nrow = 0, ncol = 4)

for(i in 1:m){

# Complete Data Set

X <- rbind(Xi, X2)

y <- c(yi, y2[i])

# Coefficients

b <- solve(t(X) %*% X, t(X) %*% y)

# Predictions

yh <- c(X %*% b)

yhi <- c(rbind(Xi, X2) %*% bi)

# Hat matrix

H <- X %*% solve(t(X) %*% X, t(X))

# Leverage New Observation

h <- H[n+1, n+1]

# Change in Predictions

preCha <- sum((yh - yhi)^2)

# Leverage Component

levCom <- h / ((1 - h)^2)

# Error Component

errCom <- (y[n+1] - yh[n+1])^2

# Saves Values

tab <- rbind(tab, c(preCha, levCom, errCom, levCom * errCom))

}

for(i in 1:m){

# Complete Data Set

X <- rbind(Xi, X1)

y <- c(yi, y1[i])

# Coefficients

b <- solve(t(X) %*% X, t(X) %*% y)

# Predictions

yh <- c(X %*% b)

yhi <- c(rbind(Xi, X1) %*% bi)

# Hat matrix

H <- X %*% solve(t(X) %*% X, t(X))

# Leverage New Observation

h <- H[n+1, n+1]

# Change in Predictions

preCha <- sum((yh - yhi)^2)

# Leverage Component

levCom <- h / ((1 - h)^2)

# Error Component

errCom <- (y[n+1] - yh[n+1])^2

# Saves Values

tab <- rbind(tab, c(preCha, levCom, errCom, levCom * errCom))

}